Airports and train stations food seller SSP (SSPG) is benefitting from its naturally captive audience as its full year results reveal strong like-for-like sales growth.

FTSE 250-listed SSP holds franchise or licence agreements with many big brands, such as Starbucks, Burger King and M&S Food. It also has its own brands Upper Crust and Caffe Ritazza.

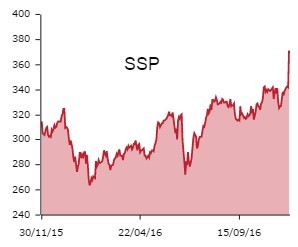

In October, SSP was labelled one to watch by Shares as it is expected to generate £2.18bn of sales in the year to September 2017. At today's 369.9p, after an 8.2% rise, the stock is already nearly 15% higher.

Increasing numbers of air passengers going through airports is a big factor in the 3% sales increase for the year to 30 September. That may not look like much but this is a mature industry. Improving the range of products, better food procurement and waste reduction are also important factors that are driving substantially bigger gains in profits.

Underlying operating profit is up 18.2% to £121.4m and its operating margin improved by 70 basis points to 6.1%.

SSP estimates that if the weaker pound continues at current spot rates through 2017, revenue will be 6% higher this year.

Panmure Gordon & Co analyst Anna Barnfather is optimistic about SSP’s UK performance and is upbeat about its strong progress in North America and Europe.

Barnfather also recognises the company’s caution about slower like-for-like growth as a result of tough comparatives and economic uncertainty this year. Even so, the analyst remains convinced on the stock's attractions.

SSP’s pipeline is encouraging, as it has been awarded several significant contracts at airports this year, including Vancouver, Los Angeles, Bangkok, Shanghai and Hong Kong.