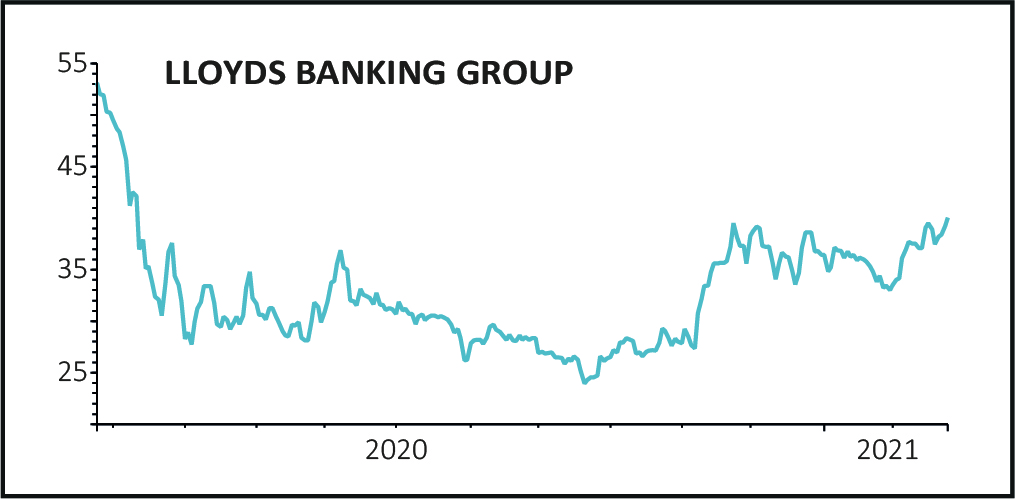

Shares in the UK’s biggest lender by market share, Lloyds Banking Group (LLOY), added 0.8% to 39.5p after initially jumping 4.5% to 41p following the publication of full year results which beat market forecasts and the promise of a ‘progressive’ dividend policy going forward.

The bank posted pre-tax profits for the year to December of £1.2 billion, a drop of 73% on 2019’s £4.4 billion but ahead of consensus estimates of £905 million.

In the fourth quarter, profits were £792 million against £1.45 billion, a fall of 45% but well above the consensus of £471 million, after the bank made provisions for doubtful loans of just £128 million against estimates of almost £600 million.

In common with other big lenders, Lloyds saw its net interest margin - the difference between the interest rate it charges on loans and the rate it pays out on deposits - shrink significantly, from 2.88% to 2.52%, due to lower demand for loans excluding mortgages, higher levels of customer deposits and the continuing low interest rate environment.

Outgoing chief executive Antonio Horta-Osorio struck an upbeat note, saying the bank was ‘now seeing positive developments in the business’, but admitted that ‘significant uncertainties remain’ over the health of the UK economy, to which the bank is ‘inextricably linked’.

Notwithstanding, the bank ended the year with a Core Equity Tier One (CET1) ratio of 16.4%, comparable to its peers, and announced a final dividend for 2020 of 0.57p per share, the maximum allowed under the regulator’s guidelines and ahead of analysts’ estimates.

It also set out a series of strategic objectives for this year including a net interest margin of no less than 2.4%, operating costs of no more than £7.5 billion (around £100 million less than last year), a return on tangible equity (ROTE) of between 5% and 7% (against just 2.3% last year) and a return to a ‘progressive and sustainable ordinary dividend policy’.

Jefferies analyst Joseph Dickerson commented: ‘Lloyds has delivered a strong finish to 2020 with a 74% beat to fourth quarter consensus pre-tax forecasts. 2021 guides tick to better net interest income and credit and suggest upside to consensus.’