Mike Ashley-controlled retail conglomerate Frasers (FRAS) expects to write down the value of its assets by more than £100 million due to the current lengthy lockdown, one that has forced the closure of stores deemed non-essential and will last at least another seven weeks.

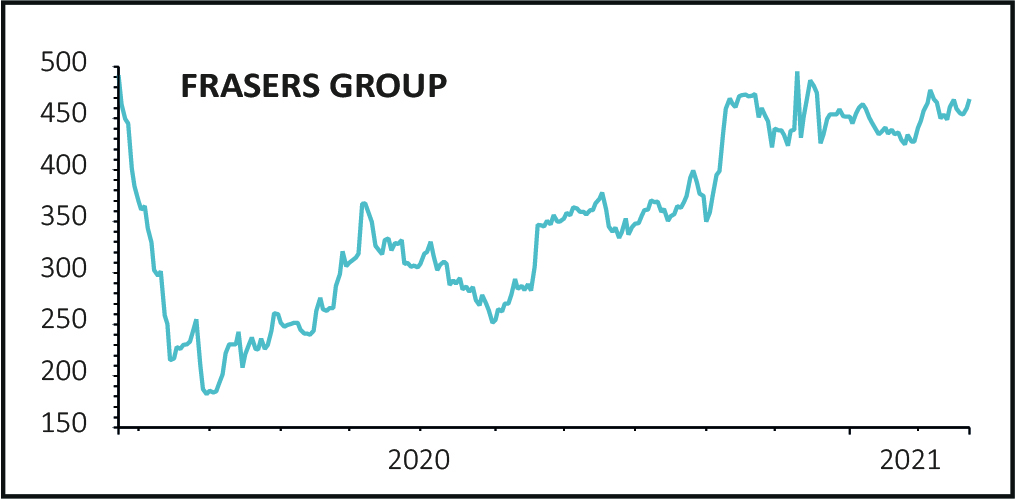

Yet shares in the Sports Direct-to-House of Fraser owner rose 4% to 478p on Tuesday, joining in a wider reopening rally on relief it should at least be able to pull up the shutters on its stores in England on 12 April.

£100 MILLION-PLUS HIT

Yesterday, Prime Minister Boris Johnson provided his roadmap out of lockdown, which included details on the potential reopening of non-essential retail stores in England, although not until 12 April 2021 at the earliest.

In response, Frasers ‘currently anticipates making material accounting impairments’ to the value of its assets including retail property due to the sheer length of the current lockdown, ‘potential systemic changes to consumer behaviour’, a nod to the structural spending shift to the web, as well as ‘the risk of further restrictions in future’.

The Shirebrook-headquartered retail giant believes this non-cash impairment ‘could be in excess of £100 million’.

ONLINE WINNER

Any such write down would be in addition to impairments included in the first half results (10 December 2020), which highlighted a ‘continuing strong online performance’, and will scar the retailer’s results for the year ending April 2021.

In common with brick and mortar competitors, Frasers has been forced to rely on its successful e-commerce business during the Covid-19 pandemic, a crisis that has hammered the UK high street and resulted in thousands of job losses.