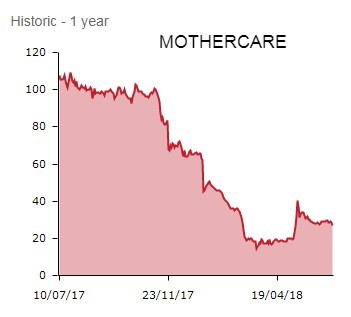

Shares in embattled mother and baby products specialist Mothercare (MTC) slump 9.1% to 26p after the rattled retailer confirms it will raise £32.5m at a discounted price.

The money will come from 19p share placing and open offer under refinancing and restructuring plans set out in May.

While the funding lifeline is a welcome boost, the heritage British retail brand says 60 UK stores will need to close on completion of its company voluntary arrangement (CVA) and the administration of its Childrens World business.

Moreover, there appears to be no respite from the testing high street conditions and cut-throat competition hurting the maternity retailer.

NO HIGH STREET RESPITE

Indeed, Mothercare concedes that current trading continues to follow the patterns seen in the second half of the last financial year, with challenging conditions in the UK and some stability visible in its international operations.

Raising the funds from the placing and open offer of new shares to existing investors would at least enable the struggling high street retailer to secure £67.5m in revised debt facilities from existing lenders.

CVAs for its Mothercare UK Limited and ELC Limited units are now effective. However, since the CVA proposal for the Childrens World Limited unit did not receive creditor approval, it will be placed in administration and 13 of its 22 stores will transfer to other Mothercare group companies and continue trading.

The completion of its other CVA proposals and administration of Childrens World will see Mothercare exit 60 UK stores and leave it with a continuing UK store estate of 77 stores by June 2019, with 19 of those stores trading with the benefit of reduced rents.

Mothercare’s sales and profits have been hammered by competition from the supermarkets and lower cost online retailers in its main UK market, not to mention rising costs.

As interim executive chairman Clive Whiley explains: ‘When I joined the business just three months ago, Mothercare faced a bleak future with growing and pressing financial stresses upon the business.

‘We have worked tirelessly as a team to get to where we are today and this fully underwritten equity issue marks the end of this initial phase, returning the group to financial stability.

‘This could not have happened without the support of all of our stakeholders for which we are very grateful.'

Whiley continues: ‘Alongside the fundraising, we have been very busy on numerous fronts to restructure the group for future profitability.

‘Whilst the lack of full approval for the Childrens World CVA was disappointing, we have now found a solution which allows us to go further and faster with the right-sizing of our store portfolio. We have also identified significant areas for further efficiencies and cost savings, which will underpin our return to a sustainable future.’

MISSED OPPORTUNITY?

AJ Bell investment director Russ Mould says Mothercare may have nearly completed its refinancing and restructuring process but the hard work to get to this point referenced by interim executive chairman Clive Whiley has only just begun.

‘The company is nearly cutting its store estate in half and trading remains weak, particularly in the UK. How long-standing shareholders must wish their board had accepted a 300p bid from US peer Destination Maternity back in 2014.

‘Claims that bid undervalued the business and its “attractive prospects” look pretty laughable now.’