Online grocer Ocado (OCDO) is being cold-shouldered by investors today, the shares cheapening 6.6p to 565.6p as first quarter retail sales growth of 11.7% to £363.4m disappoints.

CEO Tim Steiner says winter storms in the final week of the quarter to 4 March crimped Ocado’s sales, while investors are also left unimpressed by a 0.4% decline in the average order size to £110.45, despite an 11.1% hike in average orders per week to 280,000.

BEAST FROM THE EAST BITES

‘The reported rate of retail revenue growth over the quarter was broadly the same as in Q4 2017 as we operated at maximum capacity for most of the quarter and were impacted by the winter storms that caused widespread disruption during the final week,’ says Steiner, keen to thank ‘all my colleagues who nonetheless succeeded in delivering nearly 300,000 orders over the last week of the quarter, often in the most trying conditions.'

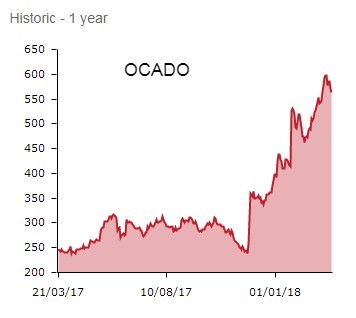

Ocado’s shares have soared of late after it successfully inked agreements to power overseas supermarkets with its technology with Groupe Casino in France and Canada’s Sobeys.

However, last month’s full year results (6 Feb) revealed a return to a pre-tax loss and a warning that 2018 profits will be pegged back by ongoing investment spend to ‘accelerate’ growth opportunities. Ocado also announced a £143m placing to facilitate the inking of these new global Ocado Solutions partnerships.

Steiner today says ‘the teams that are delivering the programmes for both Groupe Casino and Sobeys partnerships have been active and making progress’ and he remains confident ‘that our Ocado Solutions business will be able to do further deals with the momentum of new signings building over time.’

WHAT THE EXPERTS ARE SAYING

Russ Mould, investment director at AJ Bell, comments: ‘Forget the snow impacting Ocado’s earnings; the more interesting fact is the reduction in the number of items per basket.

A reduced average order size is bad news for companies like Ocado. It isn’t really cost effective to be delivering small orders to lots of different houses.

While it doesn’t give any figures for the average number of items per basket, it does say there has been a reduction. It also says this trend has effectively been offset by inflation pushing up the price of items, resulting in a 0.4% decline in the average order value to £110.45 for the 13 weeks to 4 March.

On the other hand, the average number of orders per week is growing, up 11.1% to 280,000 in the trading period.

There remains a lot of hype around Ocado and its potential for future growth. As such, its figures will be scrutinised in more depth than a business which has bigger scale and is more mature.’

Ramping up Andover and Erith will free up more delivery slots but, as ever, with Ocado it is always the promise of jam tomorrow. Time will tell if Andover can overcome its technology glitches that have beset it from the beginning but Erith’s opening later this year will allow the company to rebalance customer orders across its network.'

In more bullish mood is Killik & Co, which writes: ‘Ocado continues to perform strongly in the UK, with sales growth well ahead of the market, and strong operational performance. With two international customers now signed, we believe that the company remains in a strong position to sell its technology offering to other international retailers.'