UK telecoms watchdog Ofcom officially kick-started the process that will force BT (BT.A) to legally separate its Openreach backbone infrastructure workhorse from the rest of BT. But importantly, Openreach will remain part of the wider BT organisation albeit with its own separate board of directors.

It's a bit like that episode of Steptoe & son, 'Divided we stand', where Harold and Albert tape off parts of the house to carve out their own spaces, but the pair remain under the same roof.

BT has today unveiled the appointment of ex-Cable & Wireless and Ofcom board member Mike McTighe as chairman of Openreach, presumably hoping to pre-empt any further punitive Ofcom measures.

The decision wasn't inevitable but it looks very much like the fudge Shares suggested would be the most likely outcome back in July. Since then it appears that BT has failed to satisfy Ofcom's demands for a more independent Openreach unit, one the regulator hopes will be the main engine for superfast broadband for everyone in Britain, not just those in the bigger cities.

'Openreach has been letting consumers down for far too long, unable to meet promises of even minor improvements and becoming a household name for all the wrong reasons,' claims Dido Harding today, unsurprising criticism from the CEO of TalkTalk (TALK), one of BT's big rivals and a business reliant on getting access to BT's copper and fibre optic network.

Why hasn't Ofcom gone further? As we explained in July, 'on the one hand, Ofcom wants to encourage competition and investment in a 21st Century superfast communications infrastructure,' we wrote then. 'On the other, it cannot afford to put existing capex plans and budgets at risk.'

Philip Carse, analyst at It/comms reseach boutique Megabuyte agrees. 'Ofcom had stopped short of demanding a full structural separation of Openreach out of BT due to the costs, uncertainty and interruption involved, but still wants Openreach to be as independent as possible under BT ownership,' Carse says.

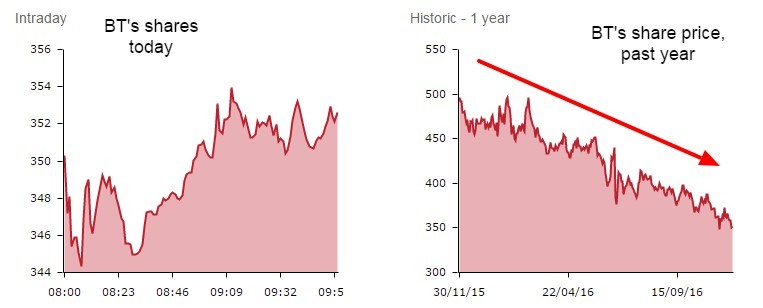

That BT's share price has barely budged today (fractionally up 0.5p at 350.8p) suggests that investors see this as a decent result for the telco giant, especially in light of its EE mobile network acquisition with barely a remedy in sight. Still, the stock has fallen a fair way through 2016 and it may also be that 'Ofcom is digging in for a final fight,' says Megabuyte's Carse.