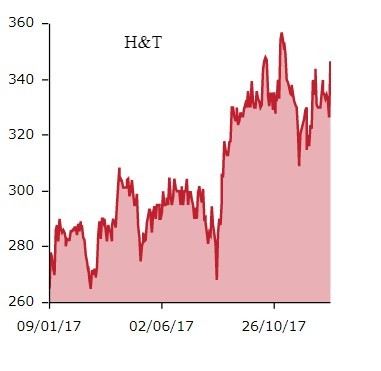

High Street pawnbroker and jewellery retailer H&T (HAT:AIM) says its pre-tax profits for 2017 will come in above market expectations.

The news has raised the company’s share price by 4.1% to 340p and caused analysts to upgrade their forecasts.

Numis has now pencilled in £13.6m for the company’s full year to 31 December pre-tax profits, up from its previous estimate of £12.6m.

For 2018 the analyst predicts pre-tax profits of £14.5m.

LOAN GROWTH

While the company has been a beneficiary of a strong gold price, the growth in its personal loan book during the year has been stellar. This nearly double (up 94.7%) in 2017 on a year-on-year basis, hitting £18.3m.

The growth in its personal loan book is said to be ‘underpinned by the expansion of H&T’s longer term, lower APR products’ according to Numis.

The company has been expanding other parts of its business, including investing in new jewellery and its store inventory more generally.

H&T’s core pawnbroking activity has also been going great guns. The company’s pledge book ended the year 11.6% ahead of 2016 at £46.1m. Numis says there’s a slower rate of pawn service charges due to lower margin revenue streams although is still encouraged by its pawnbroking division.

STOCK VALUATION

H&T trades on 10.5-times 2018’s 32.2p of earnings according to Numis’s forecasts while also paying a dividend yield of 3.2%.

If times are tough then businesses like H&T could really make hay although would need the gold price to hold up in case items have to be sold due to customer defaults.