Primark-owner Associated British Foods (ABF) says first half sales growth will be delivered by all businesses save for its sugar operation.

It also flags continued market share gains for its budget fashion arm whose profit growth is likely to accelerate in the second half.

Ahead of half year results on 17 April, ABF reiterates guidance for full year progress ‘in both adjusted operating profit and adjusted earnings per share.’

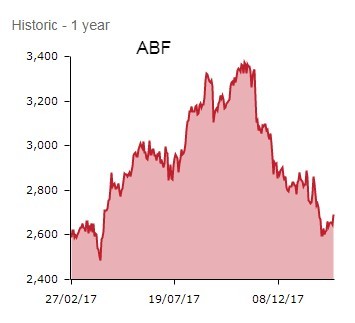

Investors welcome the news, marking shares in the FTSE 100-listed, Weston family-controlled conglomerate up 1.7% to £26.89.

SUGAR AIN’T SO SWEET

In a pre-close trading update, the £20.94bn cap guides towards flat adjusted operating profit for the half to 3 March 2018, reflecting a previously flagged drop in sugar revenues.

ABF has been hit by ‘significantly lower EU prices which are adversely affecting our UK and Spanish businesses’, although management insists ‘this will be partially mitigated by a much larger UK crop and the ongoing benefits from performance improvement projects across the business.’

PRIMARK POWER

Encouragingly, ABF’s Agriculture, Ingredients and Grocery divisions are all in growth mode, as is Retail arm Primark, the growth engine for the group.

A beneficiary of consumer down-trading, Primark continues to expand across Europe and is making encouraging inroads in the United States market, a potentially vast market for its value-oriented wares.

Sales at the cut-price clothing chain and high street star turn are forecast to be 7% ahead for the six month period, driven by retail selling space expansion.

Like-for-like sales will however show a 1% decline for the half as management blame an unseasonably warm October in Europe for crimping winter clothing sales.

Forward-looking investors are focusing on the news like-for-like sales for the more recent 16 weeks to 3 March will show 1% growth.

Not only did Primark achieve record sales in the week before Christmas, but ‘early trading of the new spring/summer range has been encouraging.’

Primark is performing well in the UK and is seeing a strong increase in total clothing market share.

Significantly, ABF also now expects an acceleration in Primark profit growth in the second half as a result of an improvement in margin over the same period last year.

‘This will be driven by better buying and some benefit of the recent weakness of the US dollar on purchases which will more than offset an expected return to a more normal level of markdowns, compared to the very low level achieved last year.’

THE EXPERTS’ VIEW

‘Overall no surprises in today’s update, and some early stage evidence in improvement in Primark’s like-for-like growth after a weather impacted Autumn/Winter season from which we take encouragement,’ writes Shore Capital analayst Darren Shirley.

‘Whilst today’s update is unlikely to materially change short term sentiment, we remain very positive on ABF and Primark over the medium to long term and reiterate our buy stance.’

‘Food and clothing seem a bizarre mix and don’t always sit well with investors who increasingly want focus on a particular area rather than conglomerate diversification.

‘Activist investors are all the rage at the moment and asset separation is one of their preferred methods of extracting value from a complex business like Associated British Foods. There’s no talk at present regarding such action, but this is certainly a situation you cannot rule out happening.’