Investors will have the opportunity to buy a slice of the iconic Camden Market when Market Tech joins the stock market on 22 December.

The company is looking to raise £100 million alongside the AIM flotation and is expected to enjoy a market valuation of some £750 million.

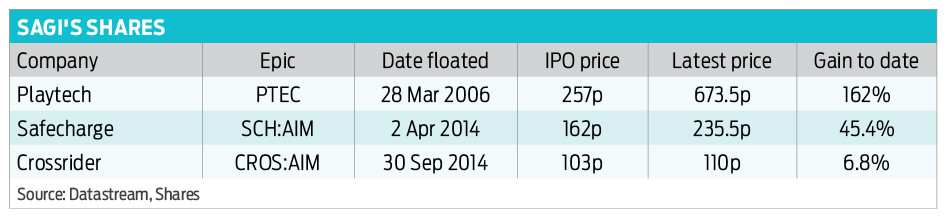

Essentially a real estate proposition with an e-commerce arm attached, the business is backed by Israeli billionaire Teddy Sagi, founder of gambling tech business Playtech (PTEC). As the charts and table indicate his previous stock market ventures have delivered significant share price appreciation.

(Click on chart to enlarge)

Sagi has spent hundreds of millions of pounds bringing the 11 acre site - which encompasses pubs, performance spaces and independent traders - under a single ownership. The cash raised alongside the float will be used to develop the existing Hawley Wharf into Camden Lock Village - a site which will incorporate commercial and retail space alongside modern housing and a new primary school.

This will sit alongside Camden Stables Market, Union Street Market and Camden Lock Market as well as separate real estate assets nearby on Camden High Street, Jamestown Road and Kentish Town Road. Chief executive officer Charles Butler tells Shares the e-commerce operation - set up as market.com - will have a symbiotic relationship with the physical market - helping to drive an increase in its 28 million annual visitors while at the same time offering traders an opportunity to sell their goods worldwide.

When quizzed on the single £5 pricing point on the website and whether this is sustainable Butler admits the website 'is still in its infancy'. He adds: 'The message is that we're investing in the existing market, this is not about changing but adding to an amazing brand.'