Shares in tour operator TUI (TUI) have plummeted 8.2% to 706.3p on its second profit warning in nearly two months as the grounding of 15 of its 737 MAX aircraft is expected to impact earnings by €200m.

TUI says earnings before interest, tax and amortisation (EBITA) will drop 17% to around €1bn, down from €1.17bn in the year ending 30 September 2018, if 737 MAX flights resume by mid-July.

READ MORE ABOUT TUI HERE

‘This impact is especially attributable to costs related to the replacement of aircraft, higher fuel costs, other disruption costs and the anticipated impact on trading,’ says the tour operator.

Unfortunately, TUI’s earnings may take a further hit if the 737 MAXs don't return to service until the end of September, potentially costing an additional €100m.

In this scenario, EBITA is forecast to be 26% lower than in 2018.

UNCERTAINTY OVER RETURN OF 737s

Boeing’s 737 MAX planes have dominated the headlines after the aircraft were grounded worldwide following safety concerns in the aftermath of two fatal crashes.

There are no set dates for when the 737s will return to service.

Ahead of the busy Easter holidays, TUI plans to use extra aircraft to guarantee customers’ holidays by extending expiring leases for planes set to be replaced by the 737s and leasing additional planes.

‘There will be sympathy for the company as this situation generally falls into the category of being out of the hands of management, but it couldn’t come at a worse time,’ comments AJ Bell investment director Russ Mould.

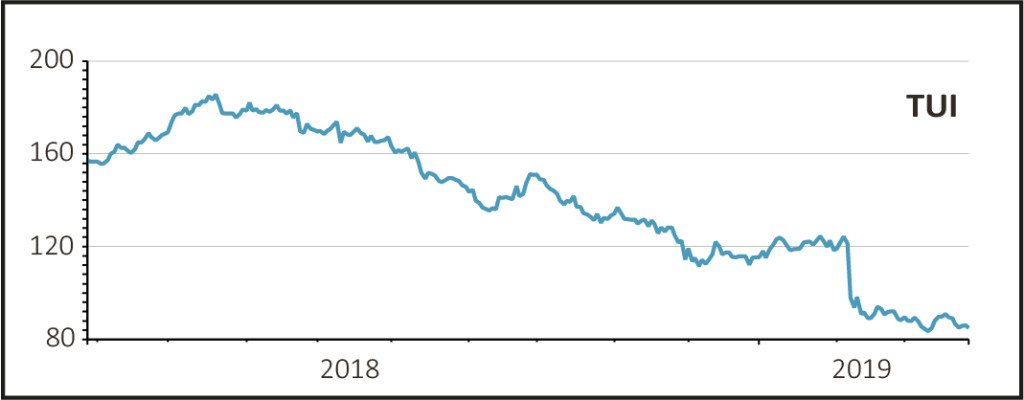

Over the last year, around half of TUI’s market value has been wiped off.

In February the company warned on profits and ditched its target of at least 10% compound annual growth in EBITA.

The tour operator blamed intense competition and the weaker pound, which affected the purchasing power of UK holidaymakers.