Struggling marketing services company St Ives (SIV) has pleased the market after hinting that trading is starting to get better following a difficult period for the company.

Its share price is up by 26.7% to 47.5p after saying the first four months to the end of May delivered a ‘much improved performance’.

The company’s core strategic marketing division is seeing like-for-like revenue growth of 7% compared to the previous financial year.

The company says that after the disappointment of project cancellations and deferrals in the final quarter of last year, which fed into the first half of the current year, the division is now delivering.

Judging by the tone of the trading statement, St Ives views this improved performance as putting the company back on track as its expectations for the full year remain unchanged.

Challenges remain

While the company is clearly pleased that it has turned a corner from its lacklustre first half performance which Shares reported here, there are still some difficulties.

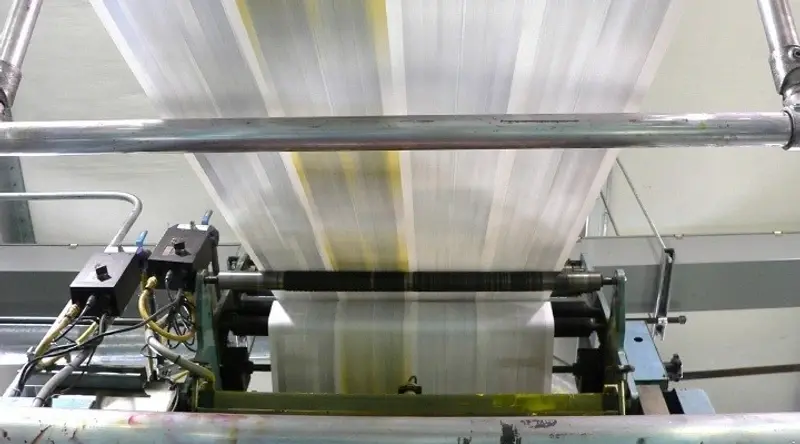

According to St Ives, its market activation segment, which delivers marketing material through a combination of print and in-store sources, remains challenging. It attributes this to ongoing pressures in the grocery retail sector with revenues flat in the four months to end of May.

Optimism

Johnathan Barrett, an analyst at stockbroker N+1 Singer, views this flat performance in market activation as a bonus, considering it was down by 3% in the first half of the company's financial year (ending 27 January 2017).

The book division has enjoyed revenue growth of 12% in the four months to end of May.

Malcolm Morgan, an analyst at stockbroker Peel Hunt, points out that this predates the loss of the Harper Collins contract which ends on 30 June 2017 and which will impact the last month of the company's financial year.

He adds that this still implies a ‘sharply better’ revenue number in the second half period.

The company is tidying up its balance sheet with the sale of non-core property in Roche for £4.2m. Barrett at N+1 Singer says this property disposal and improved debt profile ‘show the way forward’ for the company.

Barrett sets a target price of 60p suggesting a 25% upside to this stock while Morgan is even more bullish with a 90p target.

‘Further disposals would improve sentiment and focus significantly and would likely drive the share into three figures,’ says Barrett.