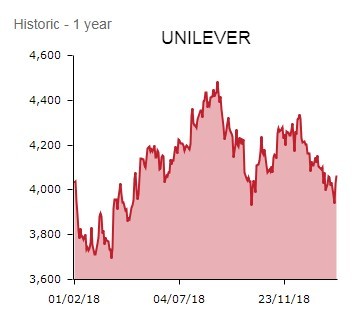

Magnum ice cream, Marmite and PG Tips brand owner Unilever (ULVR) cheapens 2.5% to £39.64 as fourth quarter sales growth falls short of consensus estimates. Also unsettling investors is the Anglo-Dutch packaged consumer goods giant’s weak revenue growth guidance for 2019, a year new CEO Alan Jope concedes will ‘remain challenging’ for his charge.

TESTING TIMES AHEAD

Full year results from Unilever, which last year capitulated to shareholder pressure and scrapped plans to shift its headquarters to the Netherlands, are solid rather than spectacular. Underlying sales growth excluding the spreads business sold last year is up a creditable 3.1%.

However, the stock market being a forward-looking discounting mechanism, all eyes are on the future not the past. Organic sales growth of 2.9% last quarter missed consensus forecasts of 3.5% growth, supported by price hikes but with volumes decelerating.

Currency devaluations and rising commodity costs have put pressure on consumer demand, especially in the second half of 2018. Argentina is even excluded from Unilever’s organic sales growth calculations due to the hyperinflation triggered by the Latin American nation’s economic crisis.

In his maiden pronouncement to the market since succeeding Paul Polman, Scotsman Jope warns:

‘In 2019 we expect market conditions to remain challenging. We anticipate underlying sales growth will be in the lower half of our multi-year 3-5% range, with continued improvement in underlying operating margin and another year of strong free cash flow. We remain on track for our 2020 goals.’

Management is targeting an underlying operating margin of 20% and cash flow conversion of 100% by 2020.

COMPOUNDER CHURNS OUT GROWTH

Despite last year’s exacting market conditions, the compounding star turn’s enviable portfolio of global brands and emerging markets presence helped Unilever shrug off sluggish, ultra-competitive developed markets.

Annual brand bright spots within Foods & Refreshment included heatwave-boosted ice cream sales in Europe, and the continued success of Domestos toilet blocks which helped drive 4.2% growth in the Home Care business.

Within Beauty & Personal Care, Dove delivered another year of growth and the high-growth Dollar Shave Club business continued to build scale in the USA.

Peering ahead, Jope says ‘accelerating growth will be our number one priority. With so many of our brands enjoying leadership positions, we have significant opportunities to develop our markets, as well as to benefit from our deep global reach and purpose-led brands.

‘We will capitalise on our strengthened organisation and portfolio, and our digital transformation programme, to bring higher levels of speed and agility. Strong delivery from our savings programmes will improve productivity and fund our growth ambitions.’

CAVEAT EMPTOR

Liberum Capital is lukewarm on the stock with a ‘hold’ rating on the shares. ‘In our view, the risk/reward outlook for the shares is balanced. Management is reinvesting two thirds of a €6bn cost savings program in growth initiatives and is committed to delivering an ambitious 20% underlying EBIT margin target by 2020.

‘While more aggressive EPS growth certainly underpins the shares, failure to deliver on lifted expectations could lead to a pull-back. In addition, the company’s bold margin targets could be unsustainable in the long run.'