Former ‘market darling’ WH Smith (SMWH) has revealed the extent to which its business has been impacted by the coronavirus and the subsequent global lockdown.

While sales in the first six months of its financial year to 29 February were up 7%, thanks to a 19% increase in travel revenues, the enforced closure of the majority of its UK high street and UK and international travel operations from mid-March has dealt the firm a devastating blow.

Revenue last month was down 85% on the previous year, with the UK high street business recording a 74% drop in sales and the travel business recording a 91% drop in sales. The firm gave no details on March trading.

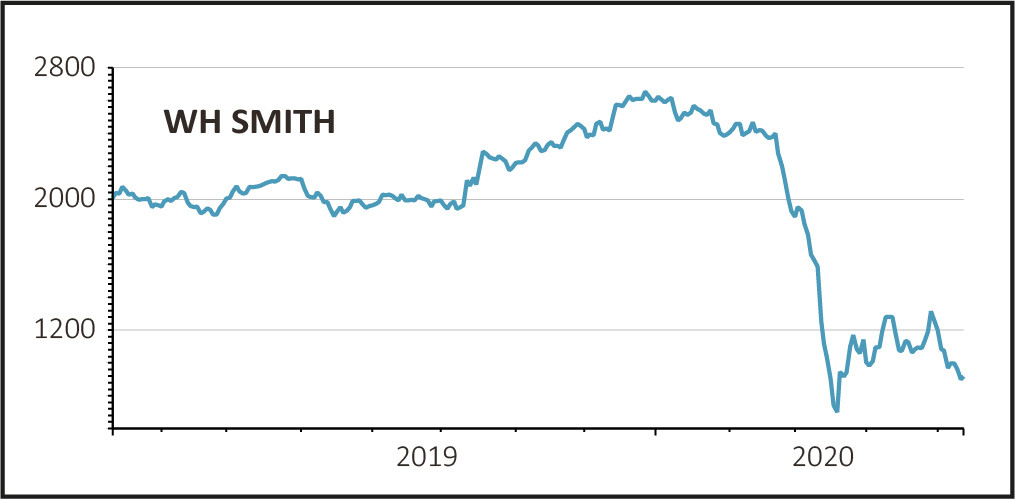

Shares fell 4.3% to 877p, taking losses for the year to date close to 70% as investors headed for the exits.

GROUNDED

From the start of 2017 to the end of 2019, WH Smith shares rose from £15 to £27, a gain of 80% compared with a 10% increase in the FTSE All-Share index over the same period.

Even though the UK high street was in dire straits, investors were bullish on the rapid expansion of the travel retail business and its global presence.

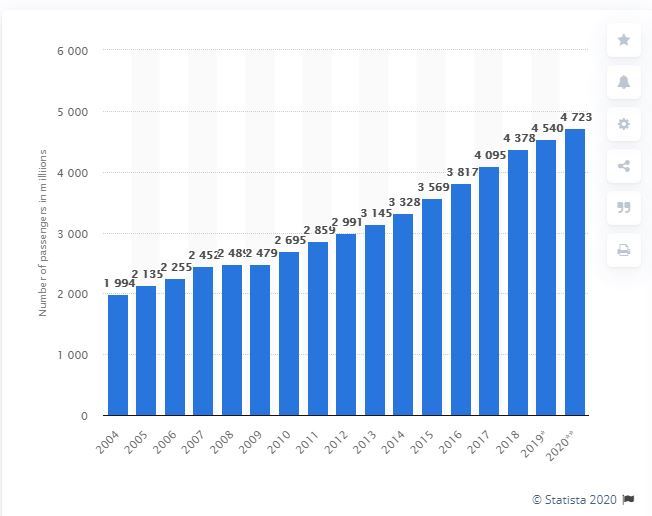

Number of scheduled passengers boarded by the global airline industry from 2004 to 2020 (source: Statista)

Between 2004 and 2019, the number of passengers boarded by the global airline industry rose from just under 2bn to more than 4.5bn, according to Statista. Pre-crisis, the forecast for 2020 was for a further increase to 4.72bn passengers.

The last thing the firm or its cheerleaders could have anticipated was a co-ordinated global economic shutdown, with airlines suspending 90% of flights and many people no longer commuting to work.

FUTURE IMPERFECT

The question now facing the business is what happens over the next 12 months. Airline passenger numbers were steady during the financial crisis from 2007 to 2009 and took off again once the crisis had passed, but coronavirus is a very different matter.

The post-Covid world could see many fewer people travelling for business or pleasure, with many more of us working from home using technology to connect with colleagues.

Smiths has modelled various ‘downside scenarios’ regarding the re-opening of its stores, using what it calls ‘severe but plausible assumptions’, and believes it has enough financial resources to survive for 12 months (ie to continue as a ‘going concern.’)

That isn’t to say that if trading deteriorates further it won’t have to come back and tap the market for more funds, as it did last month when it raised £162m by issuing new shares.

In retrospect, the acquisition of US travel retail operator Marshall Retail Group for $400m (£317m) in cash last December couldn’t have been timed worse.

With the retail and travel industries likely to be among the last areas of the economy to recover, with possibly much lower levels of activity than they enjoyed pre-crisis, the shares may struggle to reach £27 again for some time