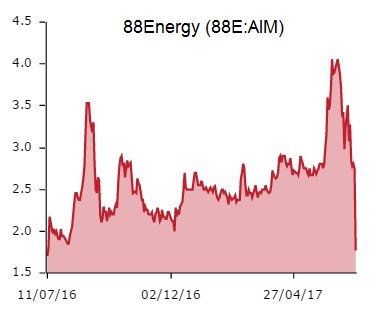

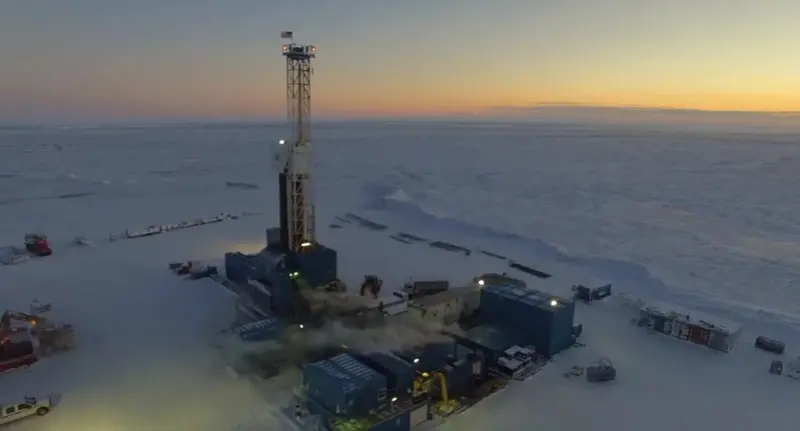

Alaskan oil and gas play 88 Energy (88E:AIM) slumps 35.5% to 1.78p as it pauses operations for six weeks to support the recovery of fracking fluid from its Icewine-2 well.

The firm says it has now recovered 16% of this total stimulation fluid, comprising 100% water. Therefore, it will shut the well in to allow pressure to build up, which the company says could displace in-situ water that may be blocking hydrocarbon molecules.

Today’s hefty share price fall does not just reflect the impatience of the market but also the company’s admission that further analysis is ‘required to determine the impact, if any, of the performance of the Icewine-2 well on the probability of success for the HRZ play at the Franklin Bluffs location and over the wider acreage position’.

BIG CLAIMS MADE

Big claims have been made for the HRZ shale play and the Icewine development as a whole, with as much as 8 billion barrels of oil ascribed to the project, and from a level of 0.3p in February 2016 the stock rocketed to hit levels above 4p in June 2017.

Originally Tangiers Petroleum, a change in name followed a shift in focus after an unsuccessful exploration effort offshore Morocco back in 2014.

Investors must now wait until the end of August to see if 88Energy can get back on track in Alaska.