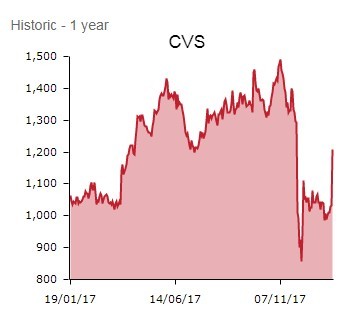

Veterinary services provider CVS (CVSG:AIM) has a spring in its step this morning with its shares rebounding 17.7% to £12.13 on news of an acceleration in like-for-like sales towards the back end of 2017.

It provides great relief to investors who were stung last year by a disappointing trading on 30 November which triggered a major share price sell-off.

SOLID SALES RECOVERY

CVS has now reported 5.6% like-for-like sales growth for the half year to 31 December 2017 with strong growth generated in its lower margin online drugs arm Animed Direct.

Stripping Animed out, like-for-like sales rose 3%, primarily reflecting ‘stronger like-for-like trading in November and December’ according to the Diss-headquartered firm.

This 3% growth represents a significant improvement on the 1.5% reported for the four months to 31 October 2017 which took the market by surprise and resulted in the share price falling by 30%.

Besides fretting over the slowing of sales in a toughening economy, CVS also flagged in its November update a shortage of clinicians coming to the UK.

Since the start of the financial year on 1 July 2017, CVS has spent around £28m on a total of 29 acquisitions of 30 surgeries, bringing the total number of surgeries to 453.

‘The pipeline of acquisitions remains strong and CVS expects to continue to complete acquisitions in the UK and the Netherlands throughout this year and beyond’, says CVS.

Investec Securities believes the new trading update will provide much relief to the market. It has upgrades its earnings estimates on the ‘solid recovery’ in like-for-like growth and recent acquisitions.

‘Whilst like-for-like growth has been more volatile than usual, CVS remains a strong defensive play with continued opportunity for upgrades through the acquisition strategy. We leave our target price unchanged at £14.45 and reiterate our buy’, adds the broker.

Despite the tough consumer backdrop, Investec forecasts a leap in pre-tax profit from £33.5m to £39m for the year to 30 June 2018 and a dividend hike to 5.4p (2017: 4.5p), ahead of £42.8m of pre-tax profit and a 6.2p payout for the 2019 financial year.

The 2018 pre-tax profit forecast represents a 4.8% upgrade on previous estimates; and 2019’s figure has been upgraded by 3.6%.

The business has historically generated strong cash flows and rising dividends thanks to operating in an industry more resilient than most, since UK animal lovers prioritise spending on the wellbeing of their pets.