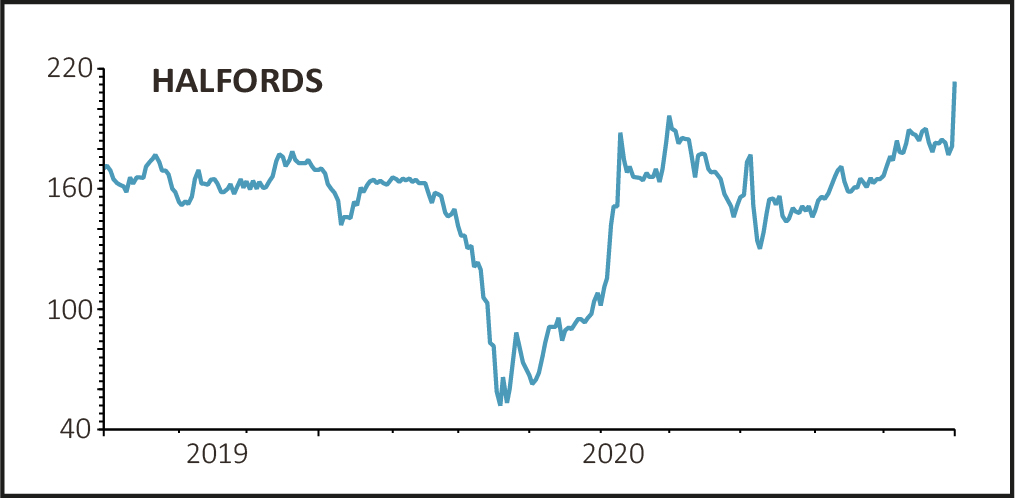

Shares in car parts-to-bicycles seller Halfords (HFD) sped 20% higher to 217p on Thursday after the retailer upgraded its first half profit guidance following a massive improvement in trading over recent weeks.

The news drove another round of sizeable earnings upgrades from analysts, although Halfords remains cautious when it comes to the outlook given mounting Covid-19 cases and Brexit-related uncertainties.

PEDAL POWER

Halfords’ first half pre-tax profit is now expected to be ‘in excess of £55 million’, up from guidance of £35 million-to-£40 million just a few weeks ago, thanks to continued momentum in cycling and motoring products and services.

Like-for-like sales growth in the five weeks to 25 September 2020 amounted to a heady 22%, driven by 46% like-for-like growth in cycling sales, delivered despite the peak summer cycling and staycation season coming to an end.

Halfords attributed the stunning cycling showing to ‘the strength of our unique proposition and continual improvement in supply to meet unprecedented levels of demand’.

The retailer also reported 7.5% like-for-like growth in motoring product sales for the five weeks, whilst the separate Autocentres business continued to grow strongly too, up 18% on a like-for-like basis and boosted by ‘exceptional demand’ for Halfords’ Mobile Expert van service.

TWIN TAILWINDS

Although it has yet to reinstate the dividend, suspended in response to the emerging Covid-19 pandemic, Halfords has flourished during the crisis, initially capitalising on its designated status as an essential services provider, then profiting from the twin tailwinds of the cycling boom and trend towards staycations.

Halfords has successfully ridden the cycling products boom, with sales of electric bikes and scooters on a growth tear and its cycling services business boosted by its free 32-point bike check and the Government's Fix your Bike Voucher scheme.

The Graham Stapleton-steered retailer has also enjoyed a return to growth in its motoring business, driven by an increase in car journeys and bumper demand for staycation-related products such as roof bars and roof boxes.

However, looking ahead to the second half of the year, Halfords remains cautious on the outlook: ‘The potential impact of second waves of Covid-19 now seems more pronounced than just a few weeks ago,’ warned the retailer, ‘and the economic impact of an end to the furlough scheme and the outcome of Brexit negotiations remains very uncertain. We are well placed to address any headwinds we may face and capitalise on the tailwinds as they arise. Our balance sheet and liquidity position remain strong.’

THE EXPERTS’ VIEW

Liberum Capital upgraded its full year 2021 pre-tax profit estimate by a whopping 48% following today’s update, which followed a very encouraging missive from Halfords earlier this month.

‘So far we have (through two upgrades), reset our full year 2021 adjusted pre-tax profit from a loss of £6.8million to a £65.4 million pre-tax profit, materially increased outer years and raised our target price to 350p,’ explained the broker.

‘We think the shares remain very cheap but should re-rate handsomely after this encouraging update. The progress management has made is driving significant growth and has enabled Halfords not only to capitalise on the current market tailwinds, but also continues to evolve the business towards a more service-led, higher margin, higher returns model.’

Russ Mould, investment director at AJ Bell, said: ‘It turns out that against Halfords’ expectations we are not a nation of fair weather cyclists after all. Having recently guided for the sales surge in bikes to wane as we head towards winter the company’s decision to raise guidance now shows it is continuing to see very strong demand.

‘The increase in forecast profit for the first half is material and will provide encouragement that the company is really getting in gear after seemingly being stuck in an endless turnaround situation for what feels like a decade or more.’