Department store Debenhams (DEB) has posted a record full year loss of almost £500m, the biggest ever deficit in its history as the new harsh reality on the UK high street bites.

The heritage British brand is also closing up to 50 underperforming stores over three-to-five years, up from the 10 previously identified as shoppers shun bricks for clicks, and has scrapped the final dividend as it fights for survival.

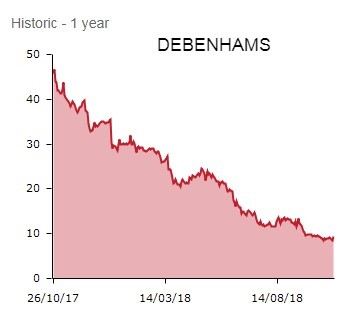

Results for the year to 1 September are undoubtedly dire, although the bombed-out shares rally 14% to 9.72p. The reason is embattled CEO Sergio Bucher and the board have carried out a ‘kitchen sink exercise’, getting as much bad news out of the way as possible in one fell swoop.

Bucher also insists his Debenhams Redesigned strategy is showing green shoots and the turnaround is gaining traction, although that seems optimistic looking at the bald numbers.

Underlying pre-tax profit (PTP) fell 65.1% to £33.2m last year and Debenhams swung from a statutory PTP of £59m to a staggering £491.5m loss, one struck after £524.7m worth of exceptional items.

Admittedly these are non-cash write-downs related to goodwill, store and lease provisions as well as an IT systems write-off, yet these impairments still demonstrate the deteriorating state of Debenhams’ future prospects.

As the UK high street crisis intensifies, Debenhams is also shuttering 50 stores rather than the previously planned 10, says it will cut costs more aggressively and is also paring back planned capital expenditure dramatically to £70m, roughly half last year’s level.

Like-for-like sales softened 2.3% last year amid weak fashion and beauty markets, although Debenhams does flag a second half acceleration in digital growth to 16%, continuing to outpace the overall market. Gross margin declined 140 basis points year-on-year due to discounting in clothing and make-up.

Glass-half-full-boss Bucher insists: ‘We are taking decisive steps to strengthen Debenhams in a market that remains volatile and challenging. Working with our new CFO Rachel Osborne, and the board, I am determined to maintain rigorous cost and capital discipline and to prioritise investment to achieve profitable growth.

‘At the same time, we are taking tough decisions on stores where financial performance is likely to deteriorate over time.

‘Debenhams remains a strong and trusted brand with 19m customers shopping with us over the past year. Our transformation strategy is gaining traction, with positive results from new product and new formats, general acclaim for our store of the future in Watford and digital growth that is outpacing the market.’

WHAT THE EXPERTS ARE SAYING?

Edison Investment Research number cruncher Paul Hickman explains that ‘the conjunction of two separate elements, weaker consumer demand, and a structural shift to online shopping, has desecrated Debenhams’ core business’, though he adds ‘debt headroom of £200m above its current £321m gives some comfort on the balance sheet.'

Liberum Capital upgrades its recommendation from ‘sell’ to ‘hold’, commenting: ‘The significant action we have been asking for has clearly been announced and we are encouraged by the more aggressive restructuring strategy to reposition the business. The fact that the dividend has been cut should have been expected so this should be seen positively as a balance sheet strengthening point as oppose to disappointment in the lack of income.'

Russ Mould, investment director at AJ Bell, comments: ‘The retailer has done a kitchen-sink job by writing down the value of assets and cancelling the dividend. None of this should be a surprise given such actions are standard practice when a new finance director joins a troubled business. Debenhams hired former Domino's Pizza (DOM) chief financial officer Rachel Osborne two months ago and she has clearly wasted no time in getting the books in order.

‘Accompanying this news is more clarity on the restructuring plan which includes reduced capital expenditure and more cost savings.

‘While store closures and rent reduction plans are natural steps to take, you have to ask whether Debenhams is really shrinking to greatness - such is the term to describe businesses which become leaner and meaner - or whether it is like a bath bomb which slowly fizzes away to nothing.'