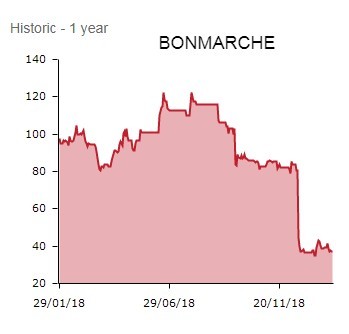

Shares in women’s value retailer Bonmarche (BON) rebound 9.5% to 40.5p as the struggling fashion chain says recent trading has been less bad than many feared following its early festive profit warning last month (13 Dec).

The market expresses relief as the Wakefield-headquartered retailer assures its under-pressure gross margins haven’t deteriorated further, the winter sale ‘has begun well’ and Bonmarche is trading in line with downgraded guidance.

LESS BAD THAN FEARED

During the final three weeks of the third quarter ended 29 December, Bonmarche traded in line with the expectations downgraded alongside last month’s damaging earnings alert, one blamed on ‘unprecedented’ trading conditions, a poor Black Friday, Brexit-related uncertainties impacting the consumer and a flurry of discounts to shift stock.

On the day of the warning, Bonmarche slashed this year’s £5.5m underlying pre-tax profit (PTP) guidance to a range of breakeven to a £4m loss.

Encouragingly, having endured a desperate October, November and early December, Bonmarche now reports that it enjoyed ‘a slight improvement in footfall’ towards the end of the crucial Christmas month (December), enabling it to stick with December’s revised guidance.

This modest uptick drove an ever-so-modest improvement in Bonmarche’s negative like-for-like sales trend, albeit store only like-for-like sales were still down 11.1% for the third quarter. Online sales continued to grow strongly in the third quarter, up 22.2%, though admittedly a slower rate than the growth generated in the first half of the year.

CEO Helen Connolly comments: ‘Clearly, in the short time since our last update, macro market conditions have not changed, but I am pleased that the sale stock is clearing well and that trading is in line with our revised expectations. In the short term, we continue to focus on ending the year with a clean stock position and ensuring that our balance sheet remains healthy.'

Indeed, investors will welcome the assurance that Bonmarche’s cash reserves should be ‘adequate to meet its liquidity requirements, even at the lowest end of the pre-tax profit range, and during the period when the cash balance is lowest, around the end of March.'

Moreover, Connolly ‘remains confident in Bonmarche’s prospects and strategy and we will continue to drive the implementation of our previously outlined plans, maintaining a particularly strong emphasis on increasing multi-channel sales.'

THE ANALYSTS’ VIEW

‘The current year is proving to be very tough for the UK retail sector and Bonmarche is not alone in the challenges it faces,’ says Cantor Fitzgerald Europe’s Mark Photiades. ‘Whilst full year 2019 is set to be a disappointing year after the encouraging results seen over the last two years, we remain confident that management can continue to enhance the business’s multi-channel credentials.'

'The online performance remains encouraging and whilst the store portfolio is suffering we would remind investors that there is a high degree of flexibility in the store estate with the average lease length just 3.6 years and leases representing circa 66% of the annual rent bill are set to expire before March 2022.'

However Investec Securities has a ‘hold’ recommendation and pares its price target from 58p to 37p, explaining: ‘Until there is better visibility on future dividend pay-outs and the business returns to sustainable profitable growth again, we believe the shares are likely to drift.'