Shares in aerospace and defence firm Babcock International (BAB) gain 4% to 483p after the company confirmed weekend press reports that it has been approached by outsourcing group Serco (SRP).

According to today’s press release, Babcock received an ‘unsolicited and highly preliminary proposal’ from Serco in late January regarding a potential all-share combination between the two firms.

Babcock says its board ‘carefully considered’ Serco’s proposal and rejected it on the basis that a combination of the two companies had ‘no strategic merit’ and wasn’t in the best interests of its shareholders, customers or stakeholders.

READ MORE ABOUT BABCOCK HERE

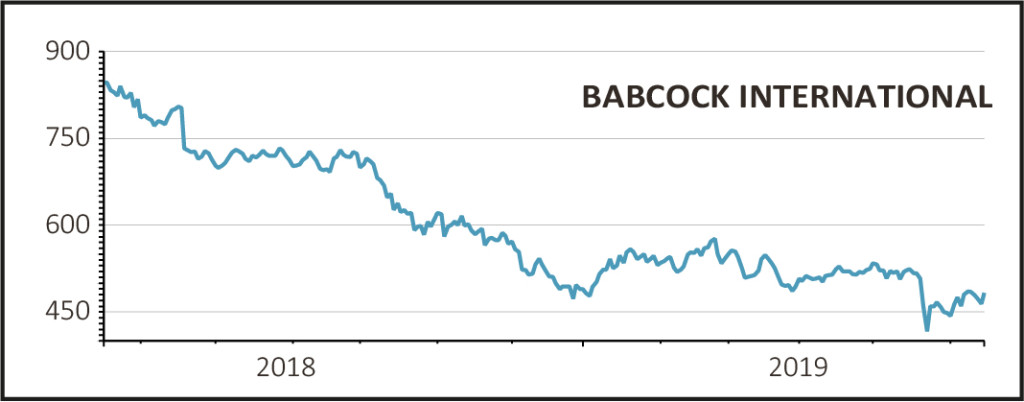

Shares in Babcock have been plumbing five-year lows after statutory operating profits for the year to 31 March fell 47% and the company warned of a number of ‘step-downs’ in contracts which it expects to reduce revenues by £410m and operating profits by £63m for the year to next March.

The firm has also been fighting off allegations by an anonymous firm, Boatman Capital Research, which claims that it needs to write down the value of its recently-acquired Defence Support Group subsidiary due to over-valuation of its contracts.

News of Serco’s approach comes on the heels of its $225m acquisition of US ship and submarine design company Naval Services Business Unit (NSBU) last month.

NSBU is a provider of naval design, systems, engineering and production as well as lifecycle support services to the US Army and Navy, with annual revenues of around $330m, and is the kind of asset that would have boosted Babcock’s existing defence business.

Serco’s shares surged 10% on the acquisition, despite needing to raise capital to finance the deal, as the market sees it moving from a multi-year restructuring phase to a new era of growth.