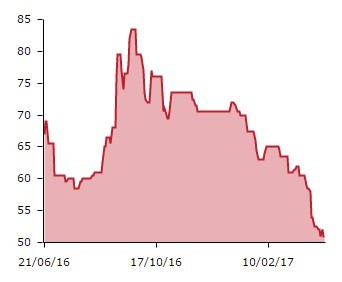

Middle Eastern-themed restaurant business Comptoir (COM:AIM) has become the second AIM-quoted casual dining stock to scale back expansion plans this year. This news, together with a poor start to trading this year, sends the share price falling 3.9% to 49p.

There is too much supply in the casual dining industry, in our opinion. The proliferation of new brands and rapid expansion of existing chains has reached saturation point, hence why you are now seeing many companies rethink their plans.

Wildwood-owner Tasty (TAST:AIM) a fortnight ago also said trading since the start of 2017 had been tough. It slashed its expansion plans in half, saying it would now only open seven new sites instead of the previously-targeted 15 restaurants.

DOWNGRADING FORECASTS

Comptoir says trading was poor in January and February, but things have picked up in March. Its decision to scale back new openings over the next two years will force analysts to downgrade earnings forecasts.

On a wider scale, Britain’s restaurant and pub groups saw like-for-like sales decline 0.5% in March, according to the latest figures from the Coffee Peach Business Tracker. One reason is Easter being a month later this year, as that long weekend tends to be a good sales catalyst for the industry.

AHEAD OF PLAN

The company, which trades under the Comptoir Libanais brand, argues its opening programme is ahead of the scheduled outlined when it joined the stock market in June 2016.

Comptoir will now only open a further three sites this year and four in 2018, saying the focus is to ‘bed in’ new sites and deliver on anticipated returns.

‘While Lebanese food is growing in popularity, it is not familiar to all our potential customers and for this reason we have to educate the local population and our sales tend to build towards maturity over a number of years rather than maturing after several months,’ says chief executive Chaker Hanna.

‘With our current small scale, the costs incurred on recruiting, training and supporting the teams put in place in our restaurants, particularly those out in more isolated regional locations, are necessarily higher than they would likely be in a much larger chain which already enjoys national coverage.’

VALUE ADVANTAGE

Comptoir's relatively low menu prices should work in the company’s favour should there be a reduction in consumer confidence and leisure spending becomes more selective.

Fundamentally we view Comptoir as having significant potential to expand in the UK, but clearly current market conditions will restrain growth. Therefore cutting back expansion is probably the right thing to do at present.

Contrarian investors with a long-term view may therefore be interested to note that its shares are now trading below the 50p IPO (initial public offering) price. They are also 41% below their September 2016 all-time high of 83.5p.