- Fund managers see India emerging as a consumer powerhouse

- Obvious manufacturing and supply chain China alternative

- Valuations are challenging after strong stock market performance

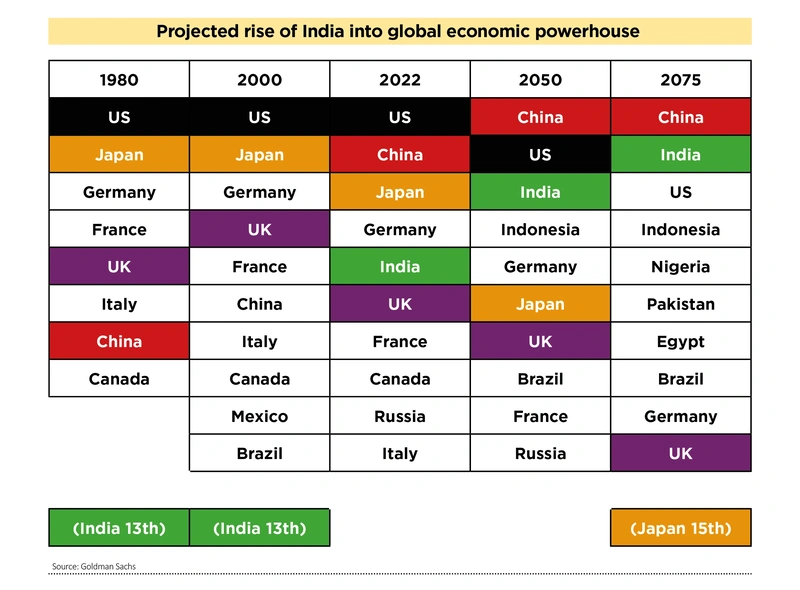

For a decade or more China has been the world’s growth powerhouse, but India is on the rise, and analysts and fund managers aplenty believe it will become the next emerging market superstar.

‘Broadly, we think India is an attractive opportunity both in Asia and across emerging markets,’ said Kristy Fong, investment manager at Abrdn New India Investment Trust (ANII).

Talking its own book, you might say, but there is strong evidence behind the optimism. India is home to over 1.4 billion people, nearly a fifth of the world’s population and believed to have overtaken China as the world’s number one earlier this year, according to the United Nations.

WHY INDIA IS GROWING SO FAST

The sheer number of people offers a vast consumer army to tap, one that is on average younger than China, has growing disposable income, high English-speaking density, and is still growing.

China versus India: What you need to know before you invest

Pro-growth reforms have seeded a large and innovative start-up community, particularly around software engineering, ecommerce and fintech. Together, this makes India a very attractive place for foreign companies. And even more so now, with political tensions between Washington and Beijing acute, meaning multi-nationals are increasingly looking for manufacturing and supply chain alternatives to China.

‘We like the country’s desire to become a global manufacturing hub,’ said Abrdn’s Fong. ‘We have seen the government’s “Make In India” campaign to incentivise foreign companies to shift their production to India through measures like production-linked incentive schemes, favourable corporate tax rates, an easier land acquisition process and the repealing of a controversial retrospective tax law.’

VALUATION CONUNDRUM

The fly in the ointment for investors? Valuations. Even managers of India-based funds admit as much. ‘Valuations look very expensive relative to other emerging markets like China,’ says Gaurav Narain, principal adviser on the India Capital Growth Fund (IGC).

‘Valuations are not very supportive, says Narain, so it is critical that India lives up to its growth story.’

According to data from Investing.com, India’s BSE Sensex and Nifty 50 indices are among the world’s best performers over the past three years, up roughly 75% each, although valuation expansion has slowed in 2023 to more sustainable high-single digits, up about 9% this year.

Even so, recent data from Bloomberg show Indian equities are among the most expensive anywhere in the world right now. Bloomberg’s calculations put Indian equities on an average CAPE ratio of about 37, even above the US’s 34, and far higher than the average for emerging markets overall, on around 16-times.

For context, CAPE is the cyclically adjusted price to earnings ratio. It is a valuation measure that divides the share price by the average inflation-adjusted earnings over the past 10 years and is designed to give investors a more accurate picture of relative valuations than the basic PE by smoothing out fluctuations in corporate profits caused by business cycles.

LONG-RUN OPPORTUNITY

Self-confessed ‘India bull’ James Thom, one of the managers on Abrdn New India Investment Trust, concedes there are headwinds for investors short term, as India’s good run means it is a natural place for global allocators to take profits.

‘That’s happening to an extent, but I think it will be a relatively short-lived rotation effect. If you’re taking a longer perspective than the next quarter or two, then I’m quite positive on the India story for this year.’

Singapore-based Chetan Sehgal, the lead manager of Templeton Emerging Markets Investment Trust (TEM) says Indian equities will likely continue to outperform other emerging markets amidst expectations for continued strong economic growth.

UK investors will have to make up their own minds, but if India’s rise is anything like China’s has been over the years, the nation could be your next emerging markets superstar stock market.

How I invest: betting big on emerging markets to deliver outsized returns