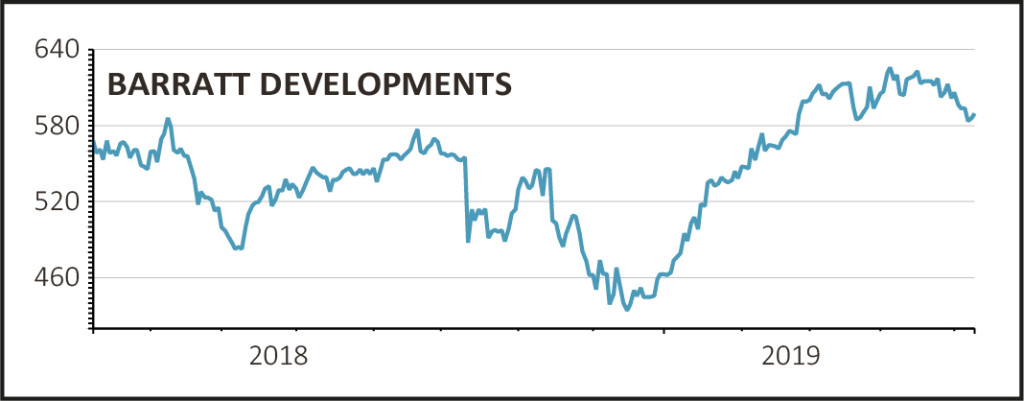

Shares in Barratt Developments (BDEV) tick up 0.3% to 587.6p as investors balance a steer for a slight beat of 2019 guidance with more gloomy data on the UK housing market.

Barratt says its outlook for the year is ‘modestly ahead’ of its previous expectations amid a strong start to the year driven by ‘good’ customer demand and amid stronger than expected margins.

This bucks the trend seen in updates from several of its peers which implied accelerating inflation in build costs, notably Taylor Wimpey (TW.) last month.

READ MORE ON BARRATT HERE

For the period from 1 January to 5 May 2019, net private reservations per active outlet per average week slipped to 0.79 from 0.80 for Barratt.

Total forward sales (including joint ventures) were up 2.4% to £3.37bn, from £3.29bn a year earlier.

Based on current market conditions, the company says it should continue to grow volume towards the lower end of its medium-term target range in 2019, in line with current market expectations.

The company is targeting medium-term volume growth of 3% to 5%, land acquisition at a minimum 23% gross margin and a minimum 25% return on capital employed (ROCE).

AJ Bell investment director Russ Mould says: ‘Volumes remain steady and although there is no explicit reference to average asking price, the modestly above expectations steer for the full year suggests there cannot have been too much of a drop off here.

‘And crucially, given the interest in the dividends paid by the sector, guidance is for a healthy net cash position at the end of the year.

‘Today’s news from Barratt and its positive outlook looks all the more impressive when you consider the latest RICS survey of the housing market suggests that, despite the threat of an immediate cliff edge Brexit being removed, there was little sign of a recovery in April.’