Embattled supermarket Sainsbury’s (SBRY) posted a worse-than-expected 1.6% decline in first quarter like-for-like sales (excluding fuel). There was particularly weak demand for clothing and general merchandise, not to mention woeful weather conditions.

The same-store sales slide posted today marks a third straight quarter of declining underlying sales and is even worse than the 0.9% reverse reported for last year’s fourth quarter.

The struggling retail institution also issued a depressing outlook statement, cautioning retail markets ‘remain highly competitive and promotional’ and warning ‘the consumer outlook continues to be uncertain’.

UNHAPPY BIRTHDAY

Chief executive officer (CEO) Mike Coupe (pictured below) remains under immense pressure to revive Sainsbury’s, whose momentous 150th birthday in May was celebrated under a cloud, and prove it can succeed as a standalone business.

This follows the Competition and Markets Authority’s (CMA) decision to block Sainsbury’s planned £7.3bn takeover of rival Asda.

Today’s update does nothing to alleviate the pressure on Coupe, forced to report sales declines in groceries, general merchandise and clothing alike for the 16 weeks to 29 June.

READ MORE ABOUT SAINSBURY’S HERE

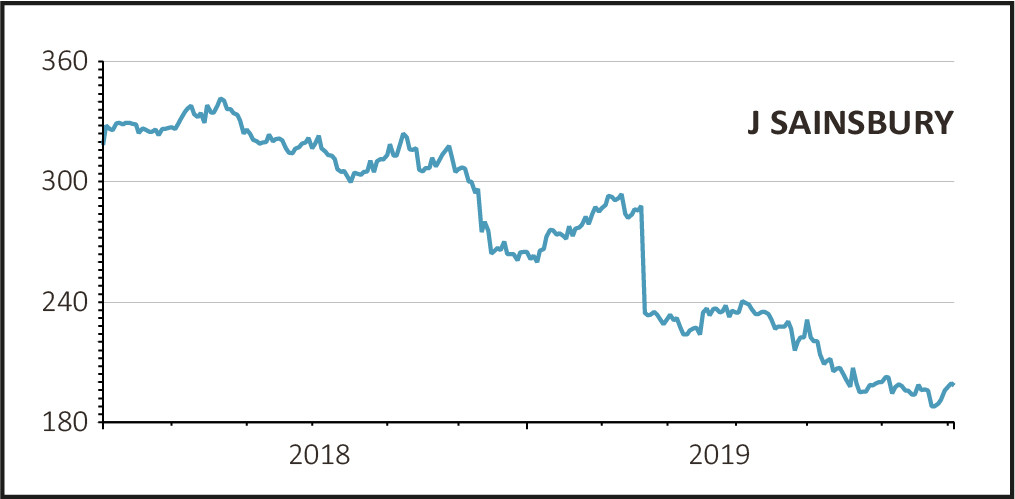

Currently trading near a 20-year low, shares in Sainsbury’s rallied 3.75p to 203.25p off their bombed-out base as Coupe emphasised the positives.

He insisted his charge continues to ‘adapt our business to changing shopping habits’ and ‘made good progress in a challenging market’ with the help of price cuts.

Coupe added: ‘Our premium Taste the Difference ranges are growing market share and we continue to improve customer service and availability. In a tough trading environment, we gained market share in key General Merchandise categories and in Clothing, where we are now the UK’s fifth largest retailer by volume.’

MUCH-NEEDED MAKEOVER

In the face of fierce competition from a resurgent Tesco (TSCO) and Morrisons (MRW) and discounters Aldi and Lidl, the 150-year old retailer appears to be going for a makeover and pinning its hopes on the youthful health and image-conscious shopper to reverse its current sales malaise.

Sainsbury’s will invest in 400 supermarkets this year, including adding an enhanced beauty range in 100 stores.

Price cuts and investment in technology are taking place alongside the introduction of plant-based lines, from the UK’s first meat-free ‘Ribz’ to Sainsbury’s ‘Vegbabs’, which have given it a near-30% share of the UK’s chilled plant-based food market.

THE EXPERTS’ VIEW

However Russ Mould, investment director at AJ Bell, explained: ‘This is not an inspiring update as every single sales metric is pointing downwards. But is it really a surprise? We already know the supermarket sector is highly competitive and Sainsbury’s is stuck in the middle - being too expensive for value shoppers and not perceived as high enough quality for the premium shoppers.

‘Now that a merger with Asda is no longer going to save the business, Sainsbury’s has to go it alone and find a way to survive and - most importantly - prosper.

‘Unfortunately it’s hard to identify Sainsbury’s edge and how it will bounce back.’

Mould continued: ‘On one hand it continues to push the non-food side of its business, helped by owning Argos. It talks about being the UK’s fifth largest clothing retailer by volume but clothing is only part of the mix and not the single factory that can save Sainsbury’s. Neither will beauty sales despite plans to roll out a larger proposition.

‘On the other hand, it is cutting prices on own brand food products and it is “on trend” with plant-based food which shows it is abreast of changing consumer tastes.

‘There is still a sense that Sainsbury’s doesn’t really know what it wants to be. Without a unique selling point it will be hard to have clear marketing strategies, targeting the right type of people and commanding customer loyalty.’