Water group Pennon (PNN) is bang on track to meet expectations for the full year to 31 March 2017, with both sides of its business ticking over nicely.

‘Our water and waste businesses are performing well and we are on track to deliver a good set of results for the full year 2016/17,’ says the company.

Pennon is a utility company very much split into two parts. Viridor provides the growth, via its 12 energy recovery facilities (ERF) which are effectively waste and recycling services. SouthWest Water is the regulated water utility bit that provides the big cash engine that pays the vital dividend.

Hitting its numbers

The latter business looks set to match the 11.7% return on regulatory equity (RORE) announced for the first half, which implies around £473m of earnings before interest, tax, depreciation and amortisation (EBITDA) on roughly £1.41bn revenue, according to consensus forecast.

That should mean a 6%-plus hike in the full year payout to 35.7p per share, keeping pace with the group’s commitment to add 4% a year over and above RPI inflation.

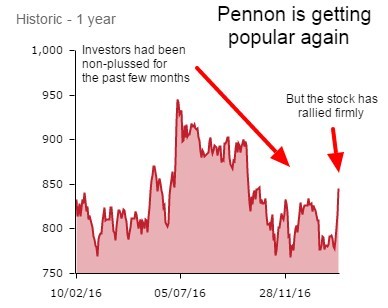

It implies a dividend yield of 4.2% this year based on the 845p share price at the time of writing. The shares are up 8.6% over the past week.

Waste centre problems

There’s a little bit of a kerfuffle in the Viridor business. A new facility in Glasgow appears to be back on track after repeat delays in getting it ready, leading to contractor Interserve (IRV) being axed.

There is also a drag on a project in Manchester, with the local authority client pleading penury thanks to the government’s ongoing austerity penny pinching.

Apparently, some sort of work around is being negotiated with contractor Costain (COST), including modifications to the original plan.

There’s also what looks like largely a side issue of a derivative contract being unwound. It appears to be a funding arrangement due to run through to 2027 but Pennon is pulling the plug because it is no longer cost effective in the post-Brexit vote UK.

As the company explains, the ‘impact for Pennon is expected to be a net cost of £35 million post-tax.’ That said, it has already been accounted on Pennon’s books through a £39.5 million derivative liability charge recognised in the half year results, published in November.