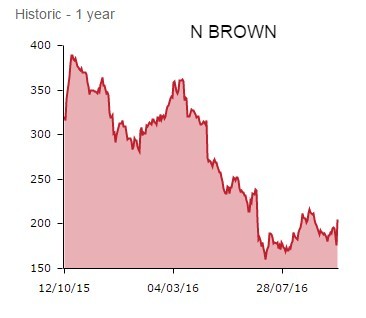

Specialist fit fashion retailer N Brown (BWNG) is firmly back in fashion with investors, shares rebounding 15% to 202.2p on the delivery of half year results ahead of expectations and the absence of further earnings downgrades.

Click here to pick through results for the half to 27 August from N Brown, a company that has endured some hard yards in recent years, which spark a sharp relief rally in the equity. Manchester-based N Brown, which has a niche focus on larger sizes and older customers, does report a 19.8% decline in adjusted profit before tax to £31.6m.

Yet this is ahead of the market's muted expectations, reflecting a strong performance across N Brown's three 'Power Brands' - JD Williams, Jacamo, Simply Be - and confirming continued progress with its digital transformation. Not long ago a staid catalogue retailer, N Brown's online penetration has grown to 68% with 70% of all traffic now arising from tablets and smartphones.

'Spring Summer was challenging for the entire retail sector, and we were not immune to this, but we demonstrated our flexibility as we improved revenue performance through the season whilst controlling our costs well,' explains CEO Angela Spindler. 'Our Power Brands continue to outperform the wider business, and I am particularly encouraged by the 11% revenue growth of the JD Williams brand,' she adds.

Investors are also pleased by two significant milestones achieved in recent weeks. The first is the granting of full FCA authorisation for N Brown's Financial Services business; this removes an uncertainty since it had been operating under a temporary licence since the FCA took over industry regulation in April 2014. The second is the launch of a new USA website; though the USA is but a small part of the business, it represents fertile territory for brands such as Simply Be.

Shore Capital (SGR:AIM) leaves its forecast for the full year to February unchanged, looking for pre-tax profits of £80.2m (2016: £84.5m) and earnings per share of 22.7p (2016: 24p), although the broker concedes visibility for its 2018 estimates is impeded by sterling's ongoing weakness against the US dollar.