Energy services giant John Wood (WG.) has bagged a contract to support one of the world’s biggest offshore oil and gas projects in Russia.

Sadly it doesn’t seem enough to win over the market as the shares trade 4.5p easier at 774.5p, given the wider oil services industry remains problematic amid volatile commodity prices.

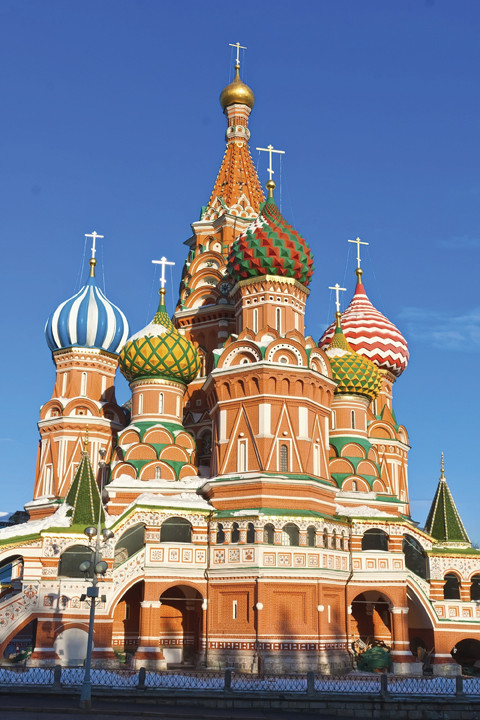

From Russia with love

Sakhalin Energy, which runs the Sakhalin-2 project, has awarded Wood a new deal that extends an already strong relationship together.

Wood has been providing engineering and construction support to offshore and onshore assets on Sakhalin Island in Russia for more than a decade.

Adding brownfield drilling upgrade services to the capabilities the £3bn cap already provides across Sakhalin Energy’s assets, the new five-year deal will be delivered by Wood’s engineering team based in Yuzhno-Sakhalinsk on Sakhalin Island.

Its offices in Australia, Norway, China and the UK will lend support.

The contract also establishes a new working relationship between Wood and an arm of Russian behemoth Gazprom, Gasproektengineering (GPE), which will ‘play a significant and growing role in supporting service delivery, working closely with Wood Group across the range and scope of services and asset base’ over the term of the contract.

Dave Stewart, CEO for Wood’s Asset Life Cycle Solutions business in the eastern region, comments: ‘Our global expertise in brownfield engineering combined with our commitment to developing the capabilities of our 200-strong workforce on Sakhalin Island enables us to successfully provide efficient and effective services that add value for our client.

‘This is an exciting and strategically important relationship for the future and one which underlines our ongoing commitment to Russian national content and development. We look forward to working in close collaboration with GPE on the safe and successful delivery of this contract.’

Deals continue to flow

While Wood continues to cheer with a steady stream of contract wins, life remains tough in the oil services market. That perhaps explains why the share price has softened following an initial spike following the latest contract win.

At the annual general meeting (AGM) earlier in May, Wood warned its overall performance for 2017 to date had been weaker than expected.

Improved activity levels in offshore projects in the West have been more than offset by softer activity in places like the North Sea and the East.

Reassuringly, Wood maintained expectations for full year trading, guiding towards a stronger performance in the second half of the year.

‘Recent awards and renewals demonstrate good customer support,’ said the company, ‘and we are seeing the enduring benefit of structural cost reductions achieved in 2016.’

Encouragingly, Wood also provided an update on its $2.7bn takeover of Amec Foster Wheeler, a deal first announced on 13 March.

It increased the level of expected annual cost synergies ‘by 36% to at least £150m by the end of the third year following completion’.