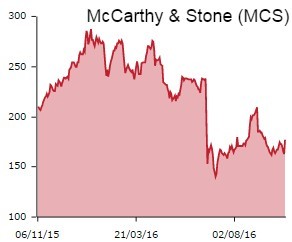

Investors breathe a huge sigh of relief as new homes building in Britain seems to have stabilised after the reactionary fall out following the UK's decision to exit the EU in June. Certainly stronger reservations and cancellation rates returning to normal for McCarthy & Stone (MCS) comes as a boost to confidence, made tangible by a 8.4% jump in the share price to 176.75p.

Immediately after the EU referendum vote, sales slowed and cancellation rates rallied as many home buyers put their immediate plans on hold. Fortunately, that increasingly looks like a temporary situation.

In today's trading update, for the very early part of the year to 31 August 2017, McCarthy & Stone says 'trading and other lead indicators are now ahead of the previous year,' a welcome return to form after the slide in forward orders at the very start of the year, when the order book decreased to £114m, versus the £131m a year earlier.

Unsurprisingly, the rally has extended right across the housebuilding sector with several share prices on the up today, including Taylor Wimpey (TW.) and Persimmon (PSN).

McCarthy & Stone says new enquiries have increased and first-time visitors are noticeably ahead of last year. The effect on forward orders is clear, now running at £173m, not far off the £177m of a year ago.

The strong performance indicates early evidence of improving customer sentiment and a potential return to normal trading conditions.

McCarthy & Stone has also announced that chief financial officer Nick Maddock will leave the firm in the first quarter of 2017 for the same position at SIG (SHI).