- Investors looking for continued sales momentum

- Consensus earnings estimates have been revised up

- Looking for signs of improving margins

Investors will be interested to see if sales momentum has continued into the final quarter at global medical technology company Smith & Nephew (SN.) when it reports next week (27 Feb).

Running into the Q4 and full-year numbers the shares have started to outperform the market, gaining around 6% compared with a 0.5% fall in the FTSE 100 index.

Another positive sign is the increase seen in analysts’ EPS (earnings per share) estimates over the last few months.

This follows a strong Q3 with revenue up 7.7% driven by broad-based growth across the firm’s three franchises.

Management took the opportunity to raise full year sales growth guidance to the top end of the 6% to 7% range, slightly above consensus estimates.

CEO Deepak Nath commented: ‘We saw strong growth in the third quarter, continuing the momentum from the first half of the year.’

The results will present the first opportunity for investors to hear from John Rogers, who joined as chief financial officer designate on 1 December 2023 and is expected to join the board during the first quarter.

Buy Smith+Nephew for recovery and rerating potential

Rogers was previously chief financial officer at WPP (WPP) and Sainsbury’s (SBRY) where he also served as chief executive of Argos, Habitat and Sainsbury’s clothing and merchandising businesses.

HOPES FOR MARGIN EXPANSION

While the company has made good progress in reigniting sales growth and taking market share in some areas there is an expectation it can also improve margins.

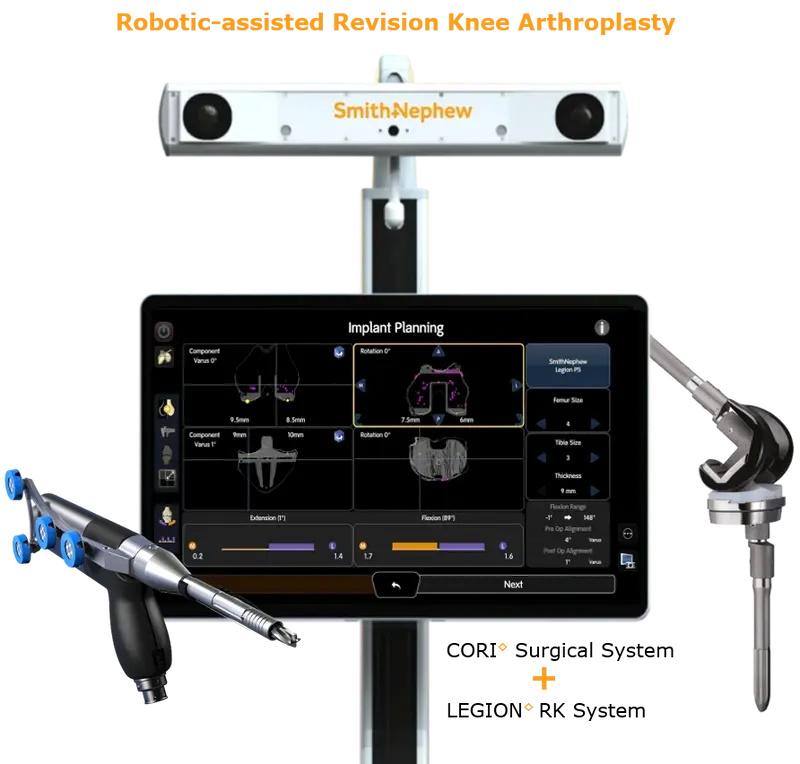

Guidance on the prospects for improving profitability will therefore be a key area of investor interest. Management has addressed the poor performance in Orthopaedics (hip and knee transplants) to improve productivity by consolidating production into larger sites and improving workflows.

In November, Smith & Nephew said it had completed around two thirds of its 12-point plan designed to improve efficiencies and drive better commercial execution. Investors will be hoping to see evidence all the hard work is starting to pay off.