Shares in FTSE 100 miner Anglo American (AAL) have edged 1.8% higher to £22.26 after it unveiled a tasty dividend, plans to return $1bn to shareholders and half year results which beat expectations.

In the six months to 30 June, the mining giant reported a 19% rise in underlying earnings before interest, tax, depreciation and amortization (EBITDA) to $5.5bn, and an 8% rise in revenue to $14.8bn.

Based on its policy of aiming to pay out 40% of underlying earnings in dividends, Anglo American also increased its half year dividend to $0.62 per share, up from $0.49 per share the year before.

In addition, the company unveiled plans to return up to $1bn to shareholders through a share buyback programme, which will start immediately and end no later than 31 March next year.

READ MORE ABOUT ANGLO AMERICAN HERE

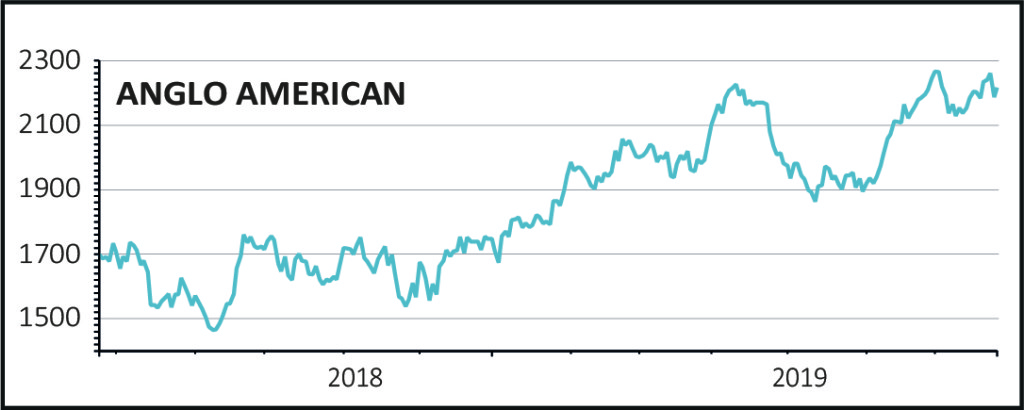

A rise of little over 1% in its share price doesn’t necessarily seem a lot when a company gives three items of good news at once, but in the year-to-date Anglo American has risen around 20% from £17.10, showing that the market has already priced in the latest news.

Its shares dropped around 3.2% yesterday along with rivals Rio Tinto (RIO) and BHP (BHP) after broking firm Liberum downgraded all three from Buy to Hold following a number of recent data points which suggest that the iron ore market might have peaked.

Anglo American is one of the largest iron ore producers in the world, and at just over $2bn, the commodity accounted for 37% of the firm’s underlying EBITDA in its half year results.

Metallurgical coal is another commodity which makes up a large part of Anglo American’s earnings, and its price has also weakened recently.

But analysts at Jeffries think that while the reduced price of iron ore and met coal could impact the firm in the short-term, any weakness this causes in its share price would be a buying opportunity.

Among the big diversified miners, i.e. those mining more than one commodity, analysts at Jeffries believe Anglo is the pick of the bunch, and while the markets for iron ore and in particular coal may not improve any time soon, they think it has the best organic growth prospects compared to its rivals, in particular because of its cost control.

The analysts said, ‘Management believes it can deliver an additional $2-3bn of annual cost and volume improvements over the next three years and has emerged as an industry leader with respect to technology and innovation in mining.’