Shares in insurers Aviva (AV.) and Legal & General (LGEN) were among the best performers on the FTSE 100 index on Friday, adding 3.3% to 281p and 1.2% to 197p respectively, following news late last night that smaller rival RSA (RSA) had received a takeover approach at a significant premium.

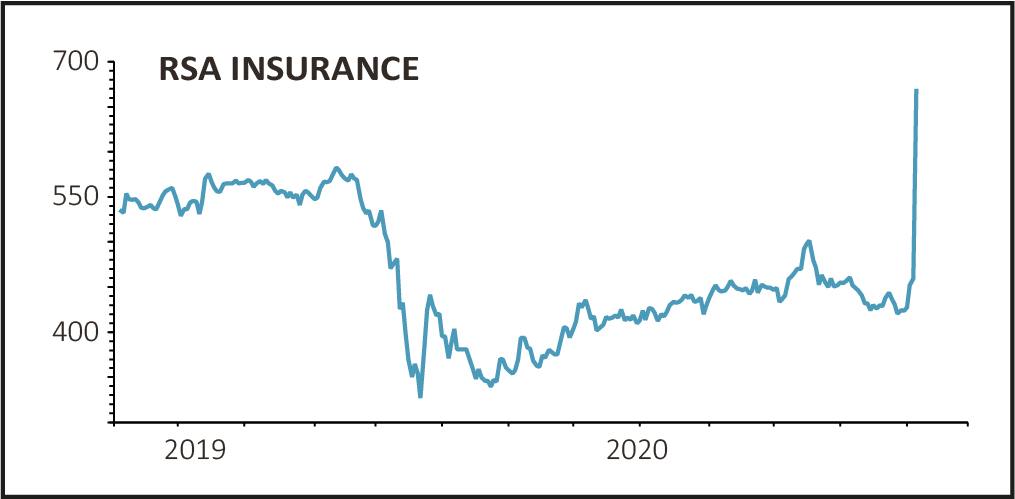

Just after the market close on Thursday, RSA revealed it had been approached over a month ago by a consortium of Danish insurer Tryg and US investor Impact Financial with a £7.2 billion or 685p per share bid for the company. Shares immediately rallied to 670p from a previous close of 459.7p.

Meanwhile smaller rival Beazley (BEZ) posted an upbeat trading statement showing a 16% jump in gross written premiums for the nine months to the end of September, ahead of its own expectations.

The commercial insurer registered a 14% increase in renewal premiums, with particularly strong growth in cyber and executive risk cover and specialty lines which rose 21% and 19% respectively in dollar terms.

Chief executive Andrew Horton commented: ‘Pricing conditions are positive and we have the expertise and the capital in place to take advantage of these market conditions. We have great confidence in our ability to deliver mid-teens growth next year and strong shareholder returns in 2021 and beyond.’

All eyes will now be on Direct Line (DLG), which is due to update the market next Tuesday, and on the UK Supreme Court hearing the following week over pay-outs to small businesses affected by the government-ordered shutdown in March.