The FTSE 100 fails to build on gains overnight in the US and Asia and is down 0.26% this morning at 6,850.82.

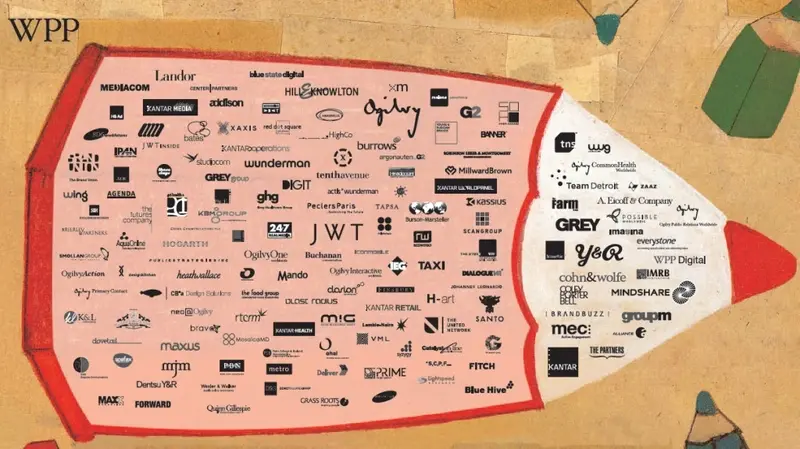

Global advertising outfit WPP (WPP), often seen as a bellwether for the wider economy, is up 3% to £18.00 on better than expected interim results. Net sales increase 3.8% against expectations for an advance of around 3.2% to 3.3%. Current trading is also buoyant with like-for-like revenue and net sales up 4.6% and 1.9% respectively in July and full-year revenue growth is expected to be ‘well over’ 3%, compared with a previous forecast of ‘over’ 3%.

Half year results from Paddy Power Betfair (PPB) reveals that integration work from the merger of the two betting companies is ahead of plan with full cost savings benefits to be achieved a year earlier than originally expected. Underlying EBITDA (earnings before interest, tax, depreciation and amortisation) increased 39% to £148 million on a proforma basis. It is guiding for full year EBITDA in the range of £365 million and £385 million. The market gives a muted reaction with shares flat at £99.62.

Glencore (GLEN) says it is highly cash generative at current commodity prices but remains alert to potential market volatility. This cautious outlook troubles investors and sends the shares down 2% to 186.08p. Half year results show a 38% decline in adjusted earnings before interest and tax to $875 million but there is an improvement in net debt, falling 9% to $23.58 billion.

Buildings and maintenance firm Carillion (CLLN) dips 0.7% to 294.1p despite posting a 24% increase in pre-tax profit to £83.9 million in the first half. The fall probably reflecting some profit taking after a strong post-Brexit recovery. The company also announces that Zafar Khan, a former finance chief at Associated British Ports, will replace Richard Adam, 59, who is set to retire at the end of the 2016 after 10 years in his post.

AstraZeneca (AZN) is to sell its antibiotics business to Pfizer for $550 million upfront plus various deferred payments and royalties potentially in excess of $1 billion. Its shares dip 0.4% to £50.43.

Russian precious metals producer Polymetal (POLY) says production and cash flow generation should pick up in the second half of the year, building on a positive first half period. Interim results reveal 67% rise in net earnings to $164 million and 4% drop in all-in sustaining cash costs. Its shares retreat 1% to £11.45.

Metals recycling group Goldplat (GDP:AIM) jumps 20% to 6.62p after saying gold price strength and the fall in the value of the pound have contributed to a strong finish to its 30 June financial year end.

Micro cap UK energy play Cluff Natural Resources (CLNR:AIM) is up 8.5% to 1.28p as it reveals additional identified prospects on its Licence P2248 in the southern North Sea are expected to bump prospective resources estimates from 760 billion cubic feet to three trillion cubic feet of gas.