FTSE 100 engineer Weir Group (WEIR) slumps 7.6% to £20.85 as it warns full-year profits could be as low as £413 million which is 7% below consensus expectations. The third quarter update from the company, which manufactures pumps and valves, blames the weak performance on delays to mining projects and a slower than forecast recovery in its oil and gas division. These are the two key areas we said investors should scrutinise when we previewed the trading update in last week's magazine.

A profit warning takes shares in Ryanair (RYA) down 12% to ?5.38. Read our thoughts here.

Europe?s largest bank HSBC (HSBA) improves 2.1% to 701.5p as its third quarter profits meet market expectation. We take a closer look at the numbers here.

News that the Serious Fraud Office is to start a criminal investigation into G4S (GFS) and Serco (SRP) electronic monitoring contracts sends the service groups down 2% to 249.8p and 0.5% to 549.5p respectively.

Strong interest prompts Merlin Entertainments to say its IPO offer will close earlier than previously announced. Retail investors now need to submit their applications by 5pm on Thursday (7 Nov). Institutional investors also need to register their interest by the same deadline. The Alton Towers-to-Legoland operator is set to join the stockmarket on Friday (8 Nov) with conditional dealings among institutions like pension funds and investment banks. The wider investment community will get their first chance to trade the stock from 13 November.

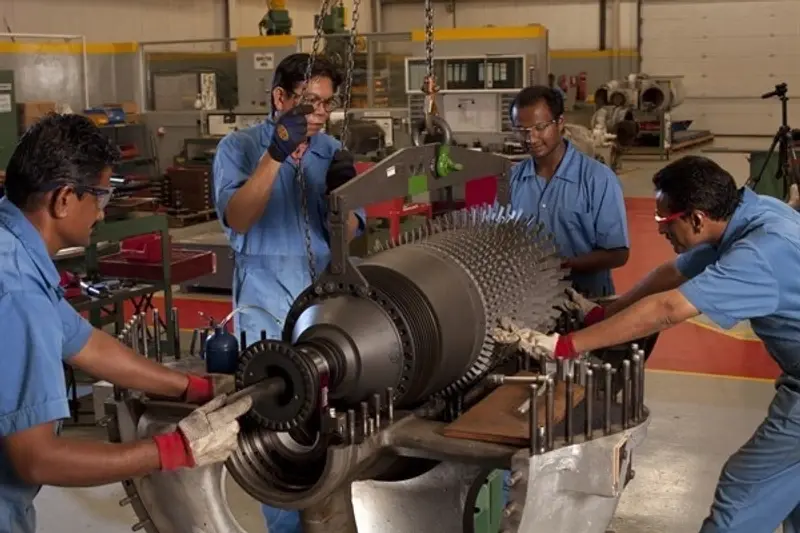

Electric motor and generator specialist Turbo Power Systems (TPS:AIM) is in gear, up 12.7% to 0.62p, as it reveals a 122% year-on-year build in order intake in the third quarter to £2.6 million. The net loss is down 87% on the same period a year ago at £210,000.

Franchised off-licence chain Conviviality Retail (CVR:AIM) cheapens 1.5p to 164p despite delivering an in-line first-year trading update. The £110.4 million cap Bargain Booze and Wine Rack owner, a running Shares Play of the Week, reports like-for-like sales 0.6% ahead with the help of a pruning of underperforming stores and improved standards across its store portfolio.

Another Shares Play of the Week, APC Technology (APC:AIM) has bought full ownership of its Minimise energy efficiency business in a £385,000 deal. That's welcome news considering its growth potential, and pushes the shares a little over 1% higher to 58p.

Middle Eastern luxury property developer DAMAC Real Estate Development is planning to list its global depositary receipts in London. The company has built properties covering 9 million square feet in the region, mainly in Dubai, and is looking for $500 million from the IPO to expand its operations further.

Chinese business-to-business web design company JQW hopes to raise unspecified funds via admitting its shares to Aim. It claims to have generated RMB 74.5 million (£7.7 million) of cash in the six months to June, giving it RMB 176.8 million (£18.2 million) of cash on the books, which makes a London listing and fund raising a little puzzling.

Co-location data centres operator Telecity (TCY) adds 2% to 775p on a third quarter update that beats the previous two and reassures the market on pricing. Analyst at Investec are quick to point out that the 'modest improvement in revenue per square metre' is vital for market confidence, with the shares struggling over the last three months (down 12%) and losing its rated finance director last week.

Winning its biggest ever contract has investors bidding up Eckoh (ECK:AIM) more than 10% to 27p. The deal, worth £11 million over 10-years, will see a Tier 1 telecos operator integrate Eckoh's EckohASSIST state-of-the-art automated customer services platform. Stockbroker Singer raises pre-tax profit estimates for 2015 and 2016 by 9% to £3 million and 8% to £3.7 million respectively. The shares have jumped 74% since early June.

Pan-African agricultural play Agriterra (AGTA:AIM) cultivates a 4.1% gain at 2.3p on well-received full-year results. The £23.4 million cap with agricultural operations in Mozambique and Sierra Leone reports record sales of US$21.2 million, although it remains in the red to the tune of $7.9 million as heavy investment continues apace.

A small but strategically-important acquisition fuels momentum in small cap payments group Universe (UNG:AIM) whose share price rises 10.2% to 8.12p. That means the stock has doubled in value since the summer. The £150,000 purchase of RST strengthens Universe's position in the general retail sector, helping to diversify the company away from its core fuel industry focus. RST provides installation, maintenance and support for electronic point of sale systems in the UK. House broker Finncap leaves its 10p price target for Universe unchanged.