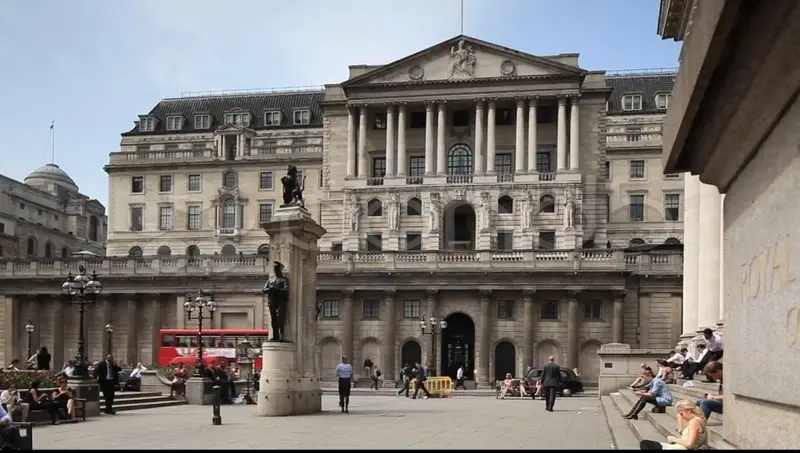

London markets are little changed in early trade on 'super Thursday' as investors look ahead to a combination of a Bank of England (BoE) rate decision and services PMI data release, which may tell us something about the direction of inflation. The FTSE 100 nudges just 15 points, or 0.2%, higher to 6,860.

There's also the latest policy announcement from the Federal Reserve to digest, which decided not to up its key interest rate, as widely expected, but indicated that a hike could be on the cards at its next meeting in December.

In UK company news. Satellites operator Inmarsat (ISAT) is among the big winners, the stock rallying close on 10% to 803.5p as third quarter results impress. The group reports a jump in third-quarter revenues following strong performances in the government and aviation divisions, but a drop in pre-tax profit.

Supermarket Morrisons (MRW) edges 1.5% up at 224.6p thanks to posting its fourth consecutive quarter of growth, helped by its biggest ever Halloween.

Going the other way is insurer Esure (ESUR), which slumps 26% at 195.9p. But looks can be deceiving, the share price reaction is in line with the demerger of its Gocompare.com (GOCO) business, which has been spun-out into a separate quoted company.

Life is sweet for former sugar colossus Tate & Lyle (TATE) as investors swoop on the stock on the back of well-received first half trading. The update shows profits soaring despite a largely flat revenue performance, once currency movements are taken into account.

Carpentry supplier Howden Joinery (HWDN) slumps 7% to 354.8p with investors underwhelmed by latest trading.

Broadcast technology minnow Zoo Digital (ZOO:AIM) soars more than 28% to 10.25p as an eventful half-year excites investors. The company reports sales and profts growth plus further customer diversification, a perceived issue in the past. But perhaps more importantly, it also flags new business with several major Hollywood film studios.

Gold mining minnow Xtract Resources (XTR:AIM) hits the skids after securing expensive-looking new funding arrangements, including a new shares subscription and an equity swap deal. The stock tanks more than 15% to 0.03p, valuing the business at little more than £4m.

Energy tiddler Plutus Powergen (PPG:AIM) is in demand as the company secures its first UK power generation site here in the UK. The sealed deal for the site in Plymouth sparks a near-12% spike in the share price to 1.68p, valuing the business at about £11.6m.