The telecoms giant is using today’s half year results to fine tune its dividend policy for future payouts.

For the record, over the past five years BT (BT.A) has paid out £4.89bn in dividends from roughly £12.6bn of net income, so about a 38% payout ratio.

REFINED PAYOUT POLICY

Today’s announcement saw the group reaffirm its promise to retain a 'progressive' dividend policy, saying it would ‘maintain or grow the dividend each year whilst reflecting a number of factors including underlying medium term earnings expectations and levels of business reinvestment.’

Previously BT’s clarification was simply that this year’s (to 31 March 2018) dividend growth would be less than 10%.

WHAT DOES THIS MEAN FOR SHAREHOLDERS?

In short, from next year (to 31 March 2019) BT plans to fix its interim, or half year, payout to 30% of the full year dividend of the previous year. It is not alone.

Other companies adopting the same dividend formula include power distribution firm National Grid (NG.), insurer Legal & General (LGEN), British American Tobacco (BAT), British Gas-owner Centrica (CNA) and the London Stock Exchange (LSE).

It’s all part of a push for greater transparency and is seen as a sensible way to implement good corporate governance.

THIS YEAR’S HALF YEAR DIVIDEND

BT is going through some massive structural changes as it balances investment in superfast broadband networks and consumer services with other demands on its cash flows, most importantly future dividends and its pension deficit.

Despite this transition BT held this year’s interim payout at 4.85p per share, kicking its new payout policy can down the road into next year. Interestingly, that’s a good for shareholders.

Under the new policy BT’s half year dividend would have been cut by around 5% to 4.62p per share, based on a 30% calculation of the last full year 15.4p payout.

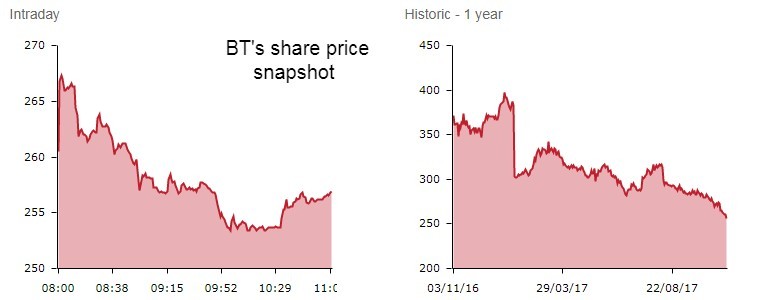

Analyst consensus for the full year dividend stands at 15.8p per share, according to Reuters data. That implies a near 6.2% income yield based on today’s modestly lower share price of 256.1p.