The FTSE 100 is down by 12.4 points to 7,132.82 after a volatile trading session on Wall Street stoked by the resignation of President Trump’s economic adviser Gary Cohn. It is believed Cohn’s departure is linked to a disagreement over Trump’s proposed tariffs on aluminium and steel.

This has heightened trade war fears and weighed heavily on some bluechip mining stocks including Glencore (GLEN) which is down 2.13%.

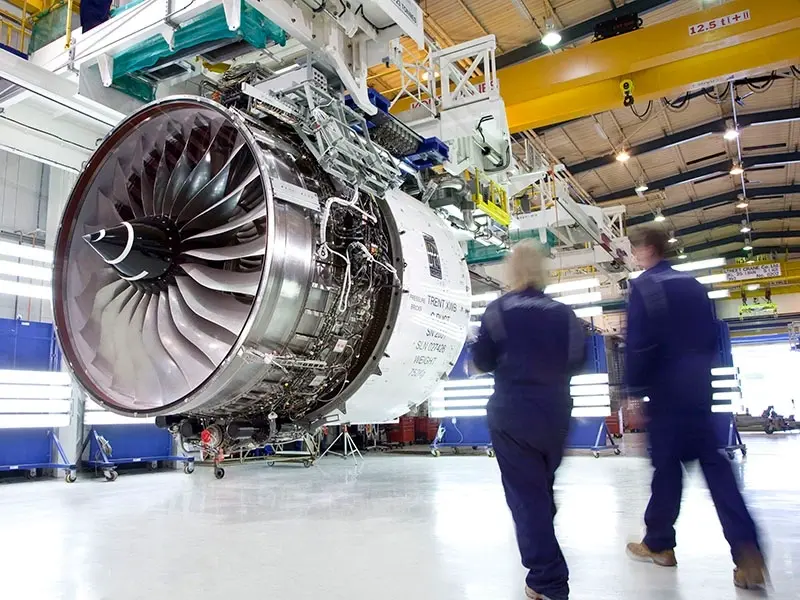

Aerospace giant Rolls-Royce (RR.) glides up 11% to 920p after posting a decent set of results for 2017. Its revenue for the year ending 31 December ticked up 6% to £15.1bn with underlying pre-tax profits up 25% to £1.1bn both on a year-on-year basis. The company has upped its production levels by delivering 35% more large engines to a record 483 units.

Bookmakers Paddy Power Betfair (PPB) shares are down 4.4% to £78.60 on releasing its 2017 results. For the year ending 31 December 2017 the company enjoyed a 13% uptick in revenue to £1.7bn and boosted its free cash flow by 57% to £395m. The company is also boosting its marketing budget in an attempt to weather the impact of regulatory changes hitting the gaming industry.

Life insurer Legal & General (LGEN) enjoys a 1.2% lift to 260.9p after posting a 32% increase in pre-tax profits to £2.1bn. The company also hiked its dividend by 7% to 15.4p per share and received a one-off US tax benefit of £246m for 2017.

Construction company Hill & Smith (HILS) advances 9.1% to £13.49 after posting record results for 2017. The company’s revenue hit a new high of £585.1m for the year ending 31 December with pre-tax profits up 15% to £70.2m on a year-on-year basis. Chief executive Derek Muir says ‘despite political and macro-economic uncertainties, we remain well positioned to again deliver another year of progress’.

Frankie and Benny owner Restaurant Group (RTN) sizzles up 13.2% to 268.8p as its results come in marginally ahead of expectations. Although for the year ending 31 December 2017, like-for-like sales were down 3%, the company reports that its pubs business ‘continues to outperform the market’. Despite its adjusted pre-tax profits being down to £56.7m compared to 2016’s £77.1m, the company’s CEO, Andy McCue says investments made are ‘driving improving volume momentum’.

Paper company Smurfit Kappa (SKG) gains 3.6% to £31.50 after the company’s board reaffirms its rejection of a takeover bid by the US company International Paper Company. The board says the offer ‘ represents a valuation multiple significantly below recent comparable transactions’.

IT services and recruitment company FDM (FDM) ticks up 5% to 932p after posting a strong set of results for 2017. The company’s revenue from its own employees, the ‘Mounties’, ticked up 23% to £207.3m while sales from its contractors improved by 23% to £233.6m, both on a year-on-year basis.

Waste management company Biffa (BIFF) shares drop 9.3% to 224.5p on news that China’s recent policy turnaround on receiving waste to recycle will impact its resource recovery and treatment division. The company also states that its balance sheet remains strong with cash generation and net debt in line with expectations.