UK stocks traded sideways on Monday as concerns over the financial health of aerospace firm Rolls-Royce (RR.) and travel and leisure stocks were offset by a general rise in pharmaceutical and healthcare stocks.

By 8.45am the FTSE 100 index was flat at 5,768 points, significantly outperforming European markets - many of which were closed on Friday for a bank holiday - which were down between 3% and 4%.

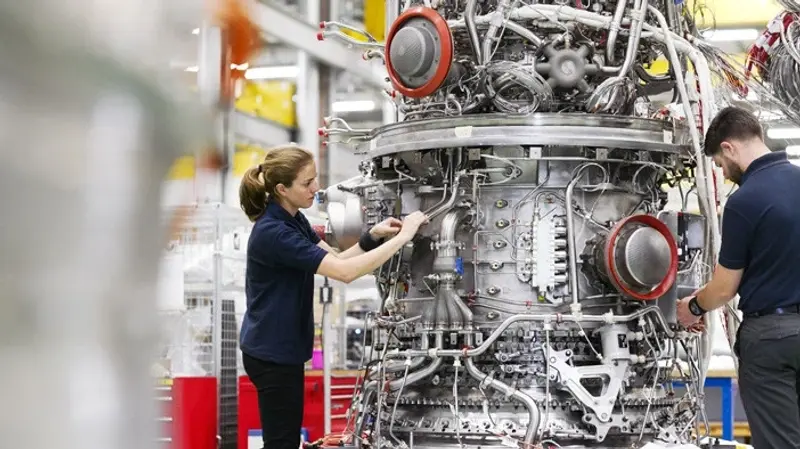

Rolls was the worst performer in the FTSE, down 5.7% to 295p, after the aero engine maker admitted it was considering laying off up to 15% of its workforce, as customers cut aircraft production and airlines remained largely grounded.

Shares in BAE Systems (BA.) were also lower, down 0.8% to 499p, despite confirmation the firm had completed the $275m acquisition of Raytheon’s airborne tactical radio unit which provides essential systems to the US defence industry as well as large aircraft manufacturers.

Meanwhile Easyjet (EZJ) and International Consolidated Airlines (IAG), which operates British Airways and Iberia, were down 4% to 544p and 3% to 208p respectively after Franco-Dutch carrier Air France-KLM gained approval from the EU competition commission for €7bn of state aid.

German carrier Lufthansa is also looking €10bn of state aid to keep operating through the crisis, in what Ryanair (RYA) chief executive Michael O’Leary has said amounts to ‘doping’ which distorts the competitive landscape for independent operators.

Shares in Tate & Lyle (TATE) drifted 2% lower to 682p despite revealing that for the 12 months to 31 March each of its business units had ‘exceeded the prior year’s performance’, meaning results would be slightly ahead of forecasts.

Regarding trading in April, weaker bulk sales of sweeteners to bars and restaurants were offset by higher demand from food and beverage producers as shoppers filled their cupboards with packaged foods.

Shares in car dealership Pendragon (PDG) skidded lower by 4% to 7.8p after the company revealed that it had held merger talks with rival Lookers (LOOK), on the basis ‘that such an exploration would have proved beneficial’, but talks had already ended, suggesting Lookers was less keen. Lookers shares gained 2% to 24.2p.

Premium chocolate maker Hotel Chocolat (HOTC) gained 0.8% to 333p after it reported that it had been overwhelmed by online orders over Easter, its second busiest trading period of the year. Analysts at Liberum estimated that the gain in online sales may have offset more than half of lost in-store sales.

Shares in insolvency litigation finance specialist Manolete (MANO:AIM) jumped 6% to 470p after it revealed a surge in case enquiries and new signed cases since the start of the year.

Case enquiries increased by 129% to 238 cases by the end of April, while new cases signed increased by 115% to 58 cases. Chief executive Steven Cooklin said he expected ‘an unavoidable knock-on effect for the UK economy’ from the coronavirus which would lead to an increase in case referrals to Manolete in the months to come.

Industrial and property services firm Hargreaves Services (HSP) announced the conditional exchange of a major commercial property development contract at its Hatfield site and said business was progressing more or less as expected.

The firm said that all business areas were trading in line with forecasts bar the property unit where the sale of residential land to Bellway (BWY) and Cruden Homes at its Edinburgh site had been pushed back from this month. Shares advanced 5% to 217p.

FOR A LIST OF FTSE 100 GAINERS AND LOSERS SEE HERE