London shares are mixed in early trade on Thursday with blue chips led up by resources and supermarkets. Midcaps ease while several stocks going ex-dividend also acts as a drag. The FTSE 100 index nudges modestly higher, up 3.5 points to 6,266, while the FTSE 250 slips close on 10 points to 17,221.

Markets are scrutinising US economic data as traders speculate on when the US Federal Reserve will lift rates, with today's jobless and goods data in focus. That leads US rates-sensitive utilities to largely taper. United Utilities (UU.) slips 1% to 954.5p despite lifting full year pre-tax profit to £353.5 million, from £341.6 million, on higher revenue. It also issues an upbeat outlook, targeting dividend growth of at least RPI inflation through to 2020. Total dividend was 38.45p, from 37.7p.

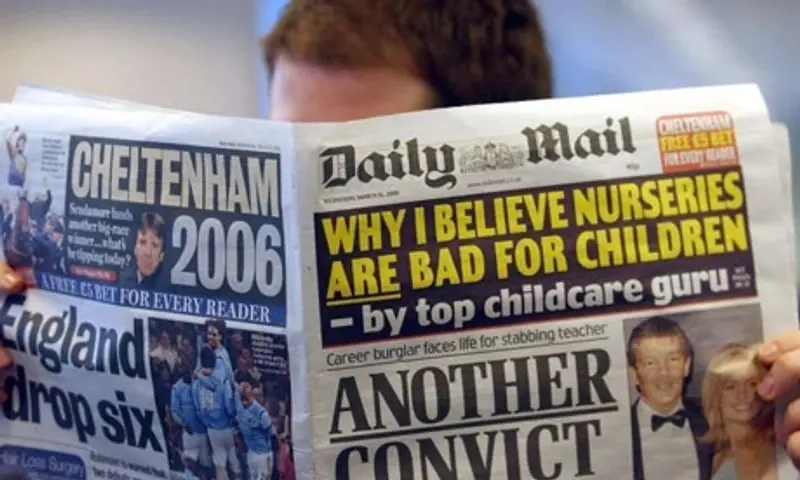

Elsewhere in corporate news, newspapers group Daily Mail (DMGT) sees its shares tumble as the company posts a drop in first-half profit and warns that a weak print advertising market will hit margins in the media business. Print advertising revenues declined 13%, reflecting a further deterioration in market conditions in the publishing world. The shares crash nearly 9% to 680p.

Department stores group Debenhams (DEB) adds a penny at 74.75p as chairman Sir Ian Cheshire announces the appointment of e-commerce expert Sergio Bucher, lured from his leading role at Amazon, as the department store's new CEO.

Food ingredients giant Tate & Lyle (TATE) sweetens up 9.5p to 623.5p on solid annual results, showing adjusted pre-tax profits of £193 million up 5% year-on-year and ahead of previous guidance, as well as a confident outlook from CEO Javed Ahmed.

Automotive retail and leasing group Marshall Motor (MMH:AIM), a running Play of the Week, accelerates 27.7% to 193.5p as investors applaud the £106.9 million acquisition of Southern England-focused dealer group Ridgeway. CEO Daksh Gupta says the takeover turns Marshall from the 10th to the 7th largest UK motor dealer group and will significantly enhance earnings in 2016, 2017 and subsequent years.

Hostel booking platform Hostelworld (HSW) crashes 27% to 188p after it reveals trading in the second quarter has been below expectations due to recent geopolitical events. Planned changes to its supporting brands' product offering have resulted in a material reduction in bookings in these channels, which means overall group bookings are marginally down on last year. Average booking value has also been lower and the group says this year's outturn will depend on a recovery in key European destinations over the summer. Read our web story exclusive here.

A tentative contract agreement worth three-times Westminster's (WSG:AIM) market value sends shares surging 155% to 14p. Micro cap Westminster has received a Letter of Intent from a large Middle East civil aviation authority to provide security services at an airport in the region worth £30 million. The deal remains subject to further contract negotiation, chief executive Peter Fowler says.

Full-year results at Paypoint (PAY) show steady underlying progress in the business, pushing shares 1.4% higher to 886p. Adjusted earnings per share is roughly flat at 58.4p though reported figures are lower because of a write-down on its up-for-sale mobile payments business.

Money troubles see niche European insurer Gable’s (GAH:AIM) shares slump 20.3% to 5.3p. Management is considering selling the business as losses for 2015 are expected to reach £14 million, meaning it will struggle to meet Solvency II’s capital reserve minimum that all insurers must hold against their liabilities, something we flagged back in December.

Smart heating and lighting designer LightwaveRF (LWRF:AIM) falls 11% to 13p after swinging to a post-tax loss of £384,000 in the six months to 13 March from a profit of £118,000 a year ago, driven be a huge increase in marketing costs and a 47% reduction in revenue. It says achieving the further reach and diversity of its distribution base 'has taken time', but its pipeline is building with an order book standing at £750,000.

Pet food-to-veterinary services provider Pets at Home (PETS) perks up 2.8% to 256.3p as finals to March show 11.2% growth in earnings per share to 15.4p, good going given seasonal challenges for its health and hygiene sales during the year, as well as a bumper 39% hike in the total dividend to 7.5p.

Cancer killing proton beam machine-maker Advanced Oncotherapy (AVO:AIM) rises 5.3% to 7.3p on securing £24 million funding from Metric Capital Partners to complete the installation of its Harley Street premises.