- Prices are turning positive again

- Lower mortgage rates helping

- Activity seen picking up this year

Housebuilders and housing-related stocks got a lift going into the Bank of England’s monetary policy meeting thanks to a positive read on the property market from the latest Nationwide house price survey.

Shares in Barratt Developments (BDEV), Crest Nicholson (CRST), Persimmon (PSN), Redrow (RDW), Rightmove (RMV) and Taylor Wimpey (TW.) were all higher by around 1% against a weak market while Vistry (VTY) shares sported a 2% gain.

POSITIVE START TO 2024

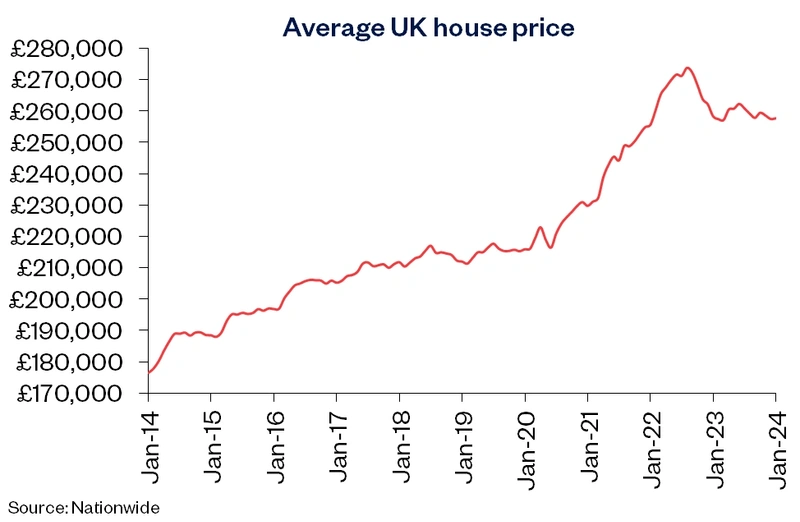

On a monthly basis, the Nationwide survey showed average UK house prices rising by 0.7% in January compared with December, while on an annual basis prices were just 0.2% lower than the previous year compared with December’s reading which was 1.8% lower.

‘There have been some encouraging signs for potential buyers recently with mortgage rates continuing to trend down’, commented Nationwide chief economist Robert Gardner.

This follows a shift in view amongst investors around the future path of interest rates, with investors becoming more optimistic that the Bank of England will lower rates in the years ahead.

‘These shifts are important as this led to a decline in the longer-term interest rates (swap rates) that underpin mortgage pricing around the turn of the year’, continued Gardner.

While a big rebound in prices and activity seems unlikely for now, a more positive outlook will be music to investors’ ears.

The data also confirms the positive trend shown by the Halifax house price index, which showed prices rising by 1.1% on a monthly basis and 1.7% on an annual basis in December (the January Halifax survey is due next Wednesday, 7 February).

CONFIDENCE RETURNING

Adding to the positive tone, the most recent RICS (Royal Institute of Chartered Surveyors) survey suggested the decline in new buyer enquiries which was a feature of the market in 2023 had abated while there were tentative signs of a pick-up in activity.

This has led to an increase in confidence among those looking to move, with average new seller prices nudging up by 1.3% or more than £4,500 in January, the biggest monthly increase since 2020, according to property portal Rightmove.

The firm has noticed ‘some tentatively promising activity in the first week of the year, markedly stronger than a year ago, as more prospective buyers and sellers seem to have the confidence to get their 2024 moving plans started early.’

In its latest report it noted the number of new properties coming onto the market for sale is 15% higher than in the same period last year, buyer demand in the first week of 2024 was 5% higher than in the same period last year and the number of sales agreed was 20% higher than during the first week of last year.

The firm also reported that since Christmas it had seen nine of its ten busiest days on record for people getting a Mortgage in Principle to see what they can afford to borrow, which is another early sign of movers getting their plans in place for 2024.